Adjustable-Rate Mortgages Are on the Rise – What Beverly Hills and Los Angeles Buyers Need to Know

If you're actively exploring homes in Los Angeles or Beverly Hills, you're likely aware that today's mortgage rateshave made affordability more challenging—especially in the luxury segment. As a result, a growing number of buyers are turning to adjustable-rate mortgages (ARMs) as a way to make more strategic financial moves in a shifting market.

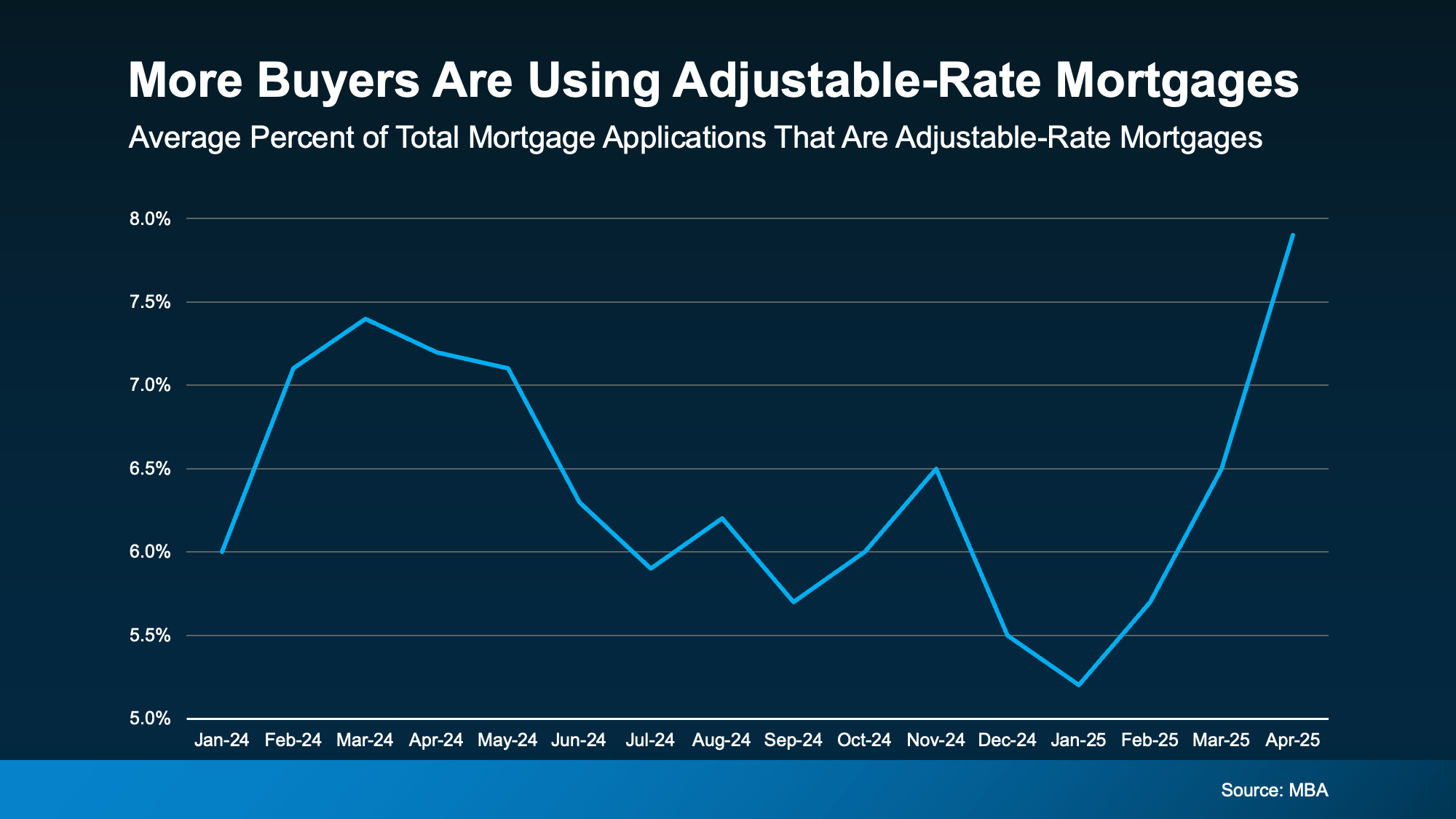

According to the Mortgage Bankers Association, the percentage of mortgage applications using ARMs has surged to nearly 8% as of April 2025—the highest it’s been in over a year. This trend suggests that even high-net-worth individuals are becoming more sophisticated and tactical in how they finance their real estate purchases.

Why Adjustable-Rate Mortgages Are Gaining Popularity Again

It’s understandable if the mention of ARMs brings flashbacks to the 2008 housing crash. But it’s important to recognize that today’s ARMs are fundamentally different from those of the past. The lending environment is now highly regulated, and banks are required to ensure that borrowers can qualify even if rates adjust upward.

In competitive, high-cost markets like Beverly Hills, Bel Air, and West Hollywood, buyers are finding that ARMs can offer significant short-term savings—especially if they plan to sell or refinance before the fixed period ends.

How an ARM Works

Here’s the basic difference:

-

A fixed-rate mortgage keeps your interest rate and monthly payments steady throughout the life of the loan.

-

An adjustable-rate mortgage offers a lower introductory rate, typically fixed for 5, 7, or 10 years. After that, the rate adjusts periodically based on current market conditions.

That initial rate can often be 0.5% to 1% lower than a comparable fixed-rate loan—which can mean major savings in the early years.

Pros and Cons for Los Angeles and Beverly Hills Buyers

Pros:

-

Lower Initial Payments: In luxury markets, this can mean qualifying for more house or keeping cash liquid for renovations, investments, or portfolio diversification.

-

Ideal for Short-Term Holds: If you’re buying a home with plans to resell or upgrade within a few years, ARMs can be a savvy financial tool.

Cons:

-

Rate Uncertainty: If you’re still in the home when the adjustment period kicks in—and rates are higher—your monthly payments could increase significantly.

-

Risk Tolerance Required: ARMs are best suited for buyers who have strong financial planning and backup strategies.

Local Market Considerations in Beverly Hills and Greater L.A.

Many local buyers in Beverly Hills Flats, Holmby Hills, and Brentwood Park are using ARMs as part of a larger wealth strategy. Given the high price points and slower pace of interest rate reductions, an ARM can free up capital while keeping monthly payments manageable in the near term.

Additionally, in a market where inventory is slowly increasing, buyers who act now may benefit from better deal flow and less competition—and an ARM could help them capitalize without overextending.

Bottom Line

In a luxury market like Los Angeles or Beverly Hills, no mortgage decision should be taken lightly. Adjustable-rate mortgages are not a one-size-fits-all solution, but they can be a powerful tool when used strategically. The key is understanding how they work, being realistic about your holding period, and working closely with your lender or financial advisor.

If you're considering buying in today’s market—or need help evaluating whether an ARM is right for your goals—I’m here to guide you with 36+ years of expertise in Beverly Hills luxury real estate.

Let’s talk strategy.