How Homeowners in Beverly Hills and Los Angeles Are Using Equity to Help the Next Generation

If you’re a homeowner in Los Angeles or Beverly Hills, you may be sitting on one of the most powerful financial tools available today: home equity. As property values in Southern California have surged over the years, simply owning your home has likely helped you build substantial wealth—often without even realizing it.

And that equity? It’s more than just a number on paper. It could be the key to changing your child’s life and helping them achieve the dream of homeownership, especially in an increasingly competitive and high-priced market like Los Angeles.

First-Time Buyers Face Major Hurdles—Even in Stable Financial Positions

Despite having good jobs and financial discipline, many first-time buyers—especially those looking to purchase in Beverly Hills, West Hollywood, or the Westside—find that homeownership feels just out of reach. The median home price in Los Angeles County remains high, and affordability challenges continue to push younger buyers to the sidelines.

But as a parent, your home equity could offer them a path forward.

According to Cotality (formerly CoreLogic), the average U.S. homeowner with a mortgage holds approximately $311,000 in equity. In Los Angeles and Beverly Hills, that number can be significantly higher, given the strong appreciation in luxury and high-demand neighborhoods over the past decade.

A Growing Trend: Parents Using Equity to Assist With Down Payments

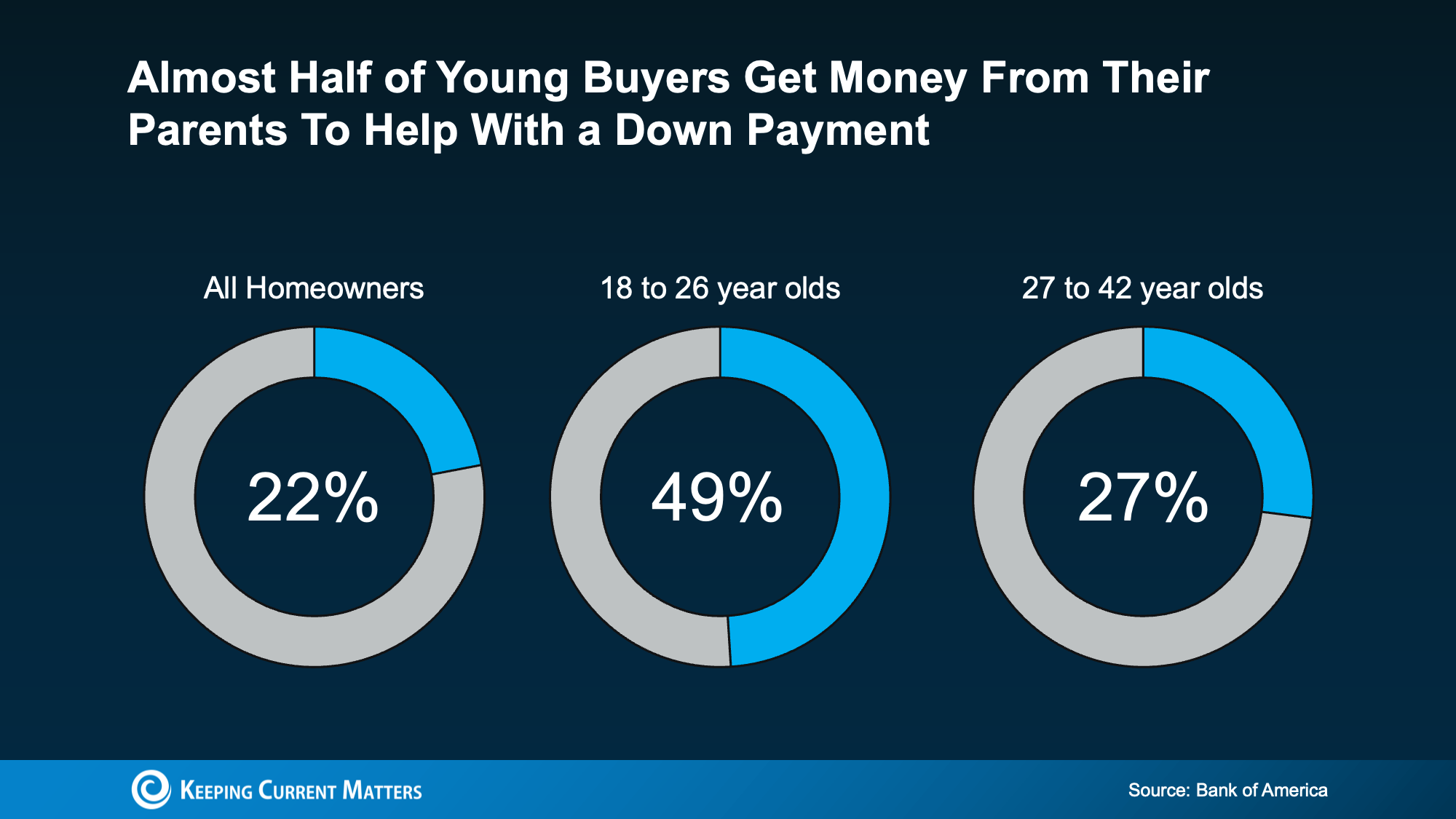

A recent study by Bank of America revealed that 49% of buyers aged 18 to 26 received financial assistance from their parents to help with a down payment. While the report didn’t detail whether that assistance came directly from home equity, it’s likely that many parents tapped into the value they’ve built in their own homes to support their children’s first purchase.

It’s more than just financial aid—it's about creating a legacy.

Helping your children purchase their first home in Los Angeles or Beverly Hills allows them to start building equity of their own in one of the most desirable markets in the world. It can also relieve the financial burden of saving for a down payment and navigating the pressures of today’s real estate landscape.

A Meaningful Opportunity to Give the Gift of Homeownership

This isn’t just about money—it’s about giving your child a head start, peace of mind, and the ability to say, “We got the house.” Whether it’s a charming condo in Westwood, a Spanish bungalow in Beverly Grove, or a starter home in Culver City, your support could be the reason they cross the threshold into homeownership.

According to Compare the Market, 45% of Americans who received parental or grandparental help said they wouldn’t have been able to purchase a home without it.

The Bottom Line

If you’re a homeowner in Beverly Hills, Los Angeles, or any of the surrounding Westside communities, your equity may hold more potential than you realize—not just for your future, but for your family’s legacy.

So ask yourself:

If helping your child buy a home in Los Angeles was more feasible than you thought, would you explore it?

Let’s talk strategy. I work closely with top lenders and financial advisors in the area and would be happy to help you assess your options. Together, we can explore how to unlock the value of your home to build a brighter future for the next generation.