How Mortgage Rate Changes Impact Real Estate in Los Angeles and Beverly Hills

How Mortgage Rate Changes Impact Real Estate in Los Angeles and Beverly Hills |Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert

If you're considering buying or selling a home in Los Angeles or Beverly Hills, you've likely been keeping a close eye on mortgage rates. These rates are crucial because they directly impact how much you can afford in your monthly mortgage payment, influencing your overall homebuying power. Understanding these fluctuations is essential for planning your real estate moves effectively.

What’s Happening with Mortgage Rates?

Recently, mortgage rates have been on a downward trend, which is promising news for homebuyers in areas like Los Angeles and Beverly Hills. However, it's important to remember that mortgage rates can be quite volatile, influenced by various factors such as the economy, job market, inflation, and the Federal Reserve's decisions. Even as rates decrease, they may still fluctuate based on new economic data. Odeta Kushi, Deputy Chief Economist at First American, notes that while we might see modest declines in mortgage rates in 2024, the path to lower rates could be unpredictable and uneven.

How Do These Changes Affect Your Homebuying Power?

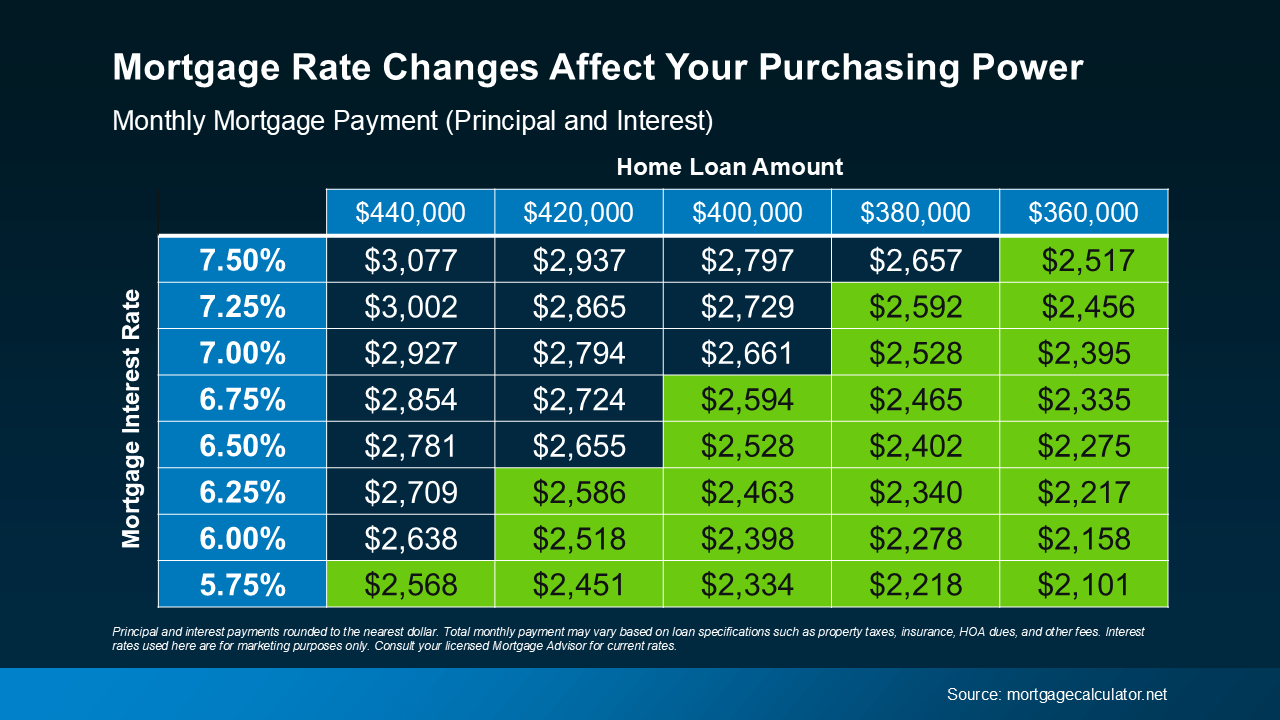

When mortgage rates change, they have a significant impact on how much you pay each month for your home loan. In high-demand markets like Los Angeles and Beverly Hills, even a slight change in mortgage rates can substantially affect your monthly payments. For example, if you're aiming for a monthly mortgage payment of $2,600, varying mortgage rates will determine how much home you can afford in these premium markets.

Understanding how these rates influence your payment is crucial for making informed decisions, especially when dealing with luxury properties in Los Angeles and Beverly Hills. The right real estate agent can provide insights and tools to help you visualize how different mortgage rates impact your buying power, enabling you to navigate the market with confidence.

How Can You Keep Track of the Latest on Rates?

Keeping up with mortgage rate trends is vital, but you don't have to do it alone. Real estate agents in Los Angeles and Beverly Hills have the expertise to help you understand the current market conditions and what they mean for your homebuying or selling journey. They can offer personalized advice, backed by data and visual tools, to ensure you make the best decisions for your situation.

Bottom Line

If you have questions about how current mortgage rates affect your real estate plans in Los Angeles or Beverly Hills, let's connect. Having a knowledgeable professional by your side will help you understand the market and navigate your homebuying or selling process smoothly.

This insight is especially important in luxury markets like Beverly Hills, where every percentage point in your mortgage rate can significantly impact your investment. Don’t navigate these waters alone—partner with a local expert who can guide you through every step.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value