Is Wall Street Really Buying All the Homes? Debunking the Myth in Los Angeles and Beverly Hills, CA

Is Wall Street Really Buying All the Homes? Debunking the Myth in Los Angeles and Beverly Hills, CA

Let’s face it—buying a home today can feel like navigating an uphill battle. You’re attending open houses, refreshing listing apps, and facing fierce competition. Somewhere along the way, you might’ve heard that the difficulty stems from big Wall Street investors snapping up properties, leaving little for everyday buyers.

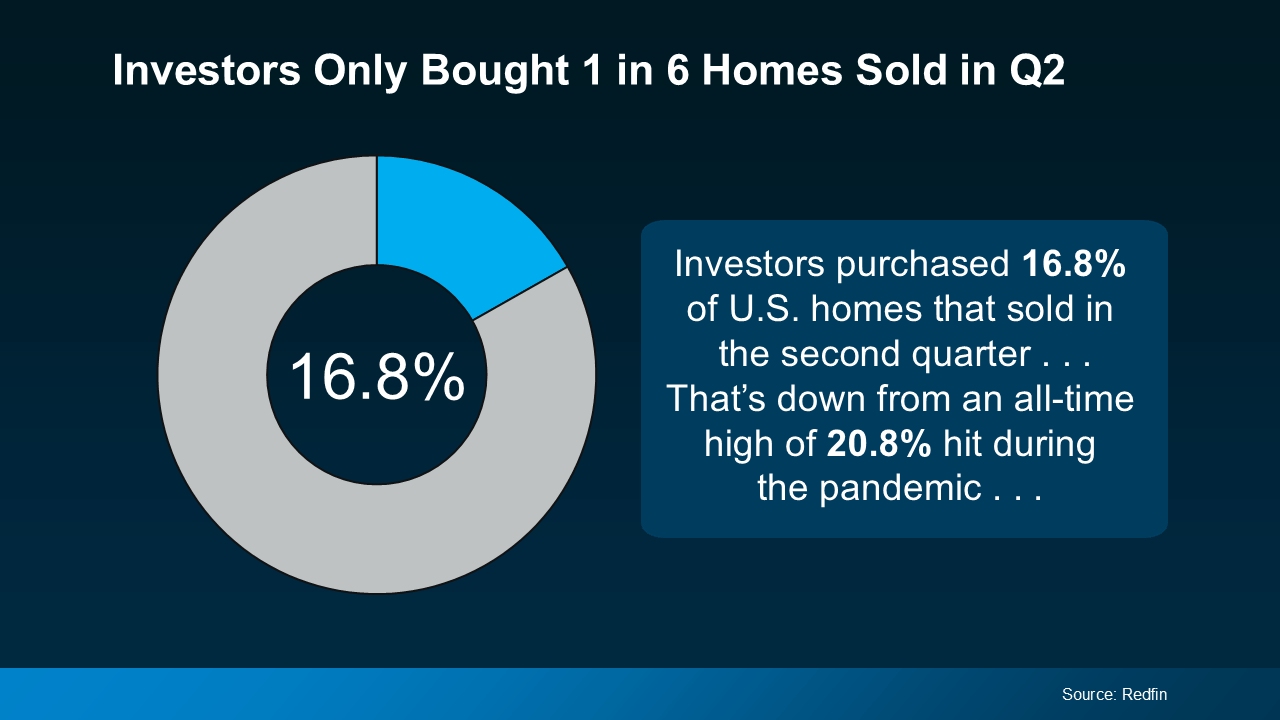

But here’s the truth: that idea is largely a myth. While investors are a part of the housing market, they don’t dominate it. According to Redfin, a whopping five out of six homes are being purchased by individual buyers, not large corporations. This means your competition isn’t primarily from Wall Street—it’s from people like you.

Let’s explore what’s really happening in the Los Angeles and Beverly Hills housing markets, and why Wall Street isn’t the roadblock you might think it is.

Most Investors Are Small-Scale, Local Buyers

The image of Wall Street giants buying up entire neighborhoods doesn’t reflect the reality of today’s housing market. Most real estate investors are small-scale, owning fewer than 10 properties. Many of these individuals are local buyers, investing in one or two homes to generate rental income or to use as vacation properties.

In Los Angeles and Beverly Hills, this is especially true. High-value properties in these markets are often purchased by individuals who see them as long-term investments or second homes, rather than mega corporations with limitless capital. Picture your neighbor renting out a guest house or a family investing in a duplex to generate additional income. These smaller, “mom-and-pop” investors dominate the local scene.

In fact, large institutional investors—those with thousands of properties—account for only about 1% of the housing market nationwide. The same trend holds true in Los Angeles, where the vast majority of homes remain under the ownership of individuals and smaller entities.

Investor Activity Is Slowing Down

If you’re worried about competing with investors, here’s some good news: investor activity is on the decline. CoreLogic reports a significant drop in investor purchases nationwide, with the numbers falling from 112,000 purchases in June 2023 to just 80,000 in June 2024. That’s a nearly 50% decline from the 2021 peak of 149,000 investor purchases.

This trend is expected to continue into 2025, even in competitive luxury markets like Beverly Hills. Rising interest rates, increased home prices, and shrinking profit margins have made it less appealing for large-scale and small-scale investors alike to purchase properties. This is creating more opportunities for traditional buyers to secure their dream homes.

Los Angeles and Beverly Hills: What Does This Mean for You?

The luxury housing markets of Los Angeles and Beverly Hills are unique. Properties here attract a mix of local buyers, international investors, and high-net-worth individuals. While these markets remain competitive, they’re not dominated by Wall Street investors. Instead, competition often comes from other buyers who are just as eager to find the perfect home.

For example, in Beverly Hills, many buyers are looking for properties with celebrity appeal, architectural significance, or iconic locations like the Flats. Similarly, in Los Angeles neighborhoods like Brentwood or Bel Air, buyers are drawn to the combination of modern luxury and historical charm. These unique preferences often outweigh the interest of large-scale investors, leaving the field open for individual buyers to find properties that align with their lifestyle and goals.

Key Takeaways for Los Angeles Buyers and Sellers

- Focus on Your Goals: Knowing that Wall Street isn’t dominating the market, you can focus on finding the right home for your needs without worrying about massive corporations outbidding you.

- Leverage Local Expertise: Partner with a local real estate agent who understands the nuances of neighborhoods like Beverly Hills, Brentwood, or Hancock Park. They can help you navigate competitive offers and find hidden gems.

- Understand Market Trends: While investor activity has slowed, local trends in Los Angeles and Beverly Hills still point to strong demand for luxury properties. This means sellers can still capitalize on high prices, while buyers may find more negotiating power in the current market.

Bottom Line

The myth that Wall Street is buying all the homes can be put to rest. In Los Angeles and Beverly Hills, the majority of homes are purchased by individual buyers and small-scale investors. Plus, overall investor activity is slowing, which means you’re likely competing with other homeowners—not Wall Street giants.

Whether you’re looking to buy your next dream home in Beverly Hills or sell a stunning Los Angeles property, let’s connect. Together, we’ll navigate this exciting market and help you achieve your real estate goals.