Is Your Home Still Right for Retirement? Why Many in Los Angeles and Beverly Hills Are Rethinking Where They Live

Is Your Home Still Right for Retirement? Why Many in Los Angeles and Beverly Hills Are Rethinking Where They Live

Retirement isn’t just a milestone—it’s a transformation. For residents of Los Angeles and Beverly Hills, CA, it marks a transition from the fast-paced hustle of career-building to a time of freedom, fulfillment, and lifestyle-first living. Whether your dream retirement includes traveling the world, embracing new hobbies, or simply spending more time with family, where you live plays a huge role in making that vision a reality.

But here’s the question: Does your current home—and location—still make sense for this next phase of your life?

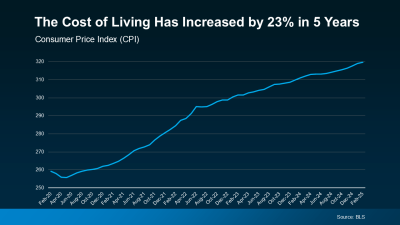

The Cost of Living Has Risen—And It’s Impacting Retirement Plans

According to recent data from the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI) shows that the cost of living has increased by 23% in just the last five years. That means everyday expenses—groceries, transportation, utilities, and especially housing—are significantly higher than they were in 2020.

For retirees in Los Angeles, where the cost of living is already among the highest in the nation, this shift has created new financial challenges. From property taxes in Beverly Hills to rising healthcare and service costs across Southern California, it's no surprise that many are reassessing whether their current home is still the best fit.

Why Downsizing or Relocating May Be a Smart Move

Many savvy retirees are taking control by downsizing or relocating to more cost-efficient areas—without compromising luxury or lifestyle. Even within Los Angeles County, there are substantial differences in price per square foot, HOA fees, and property tax rates. By moving from a sprawling estate in Beverly Hills to a modern condo in Westwood or Century City, retirees can unlock home equity, reduce upkeep, and free up budget for travel, leisure, or gifting.

Or, if you’re ready for a bigger change, relocating out of Los Angeles entirely to a more tax-friendly state like Nevada or Texas might stretch your retirement dollars further while still providing luxury living.

✅ Popular Real Estate Options for Retirees in the Los Angeles Area:

High-rise condos with concierge service in Century City

Gated communities in Calabasas with strong resale value

Ocean-view townhomes in Malibu offering lock-and-leave freedom

Walkable neighborhoods in Pasadena or Santa Monica with cultural amenities

Planning Ahead = Retiring Smart

As Go Banking Rates aptly states:

“How much you should have saved for retirement depends on a few key factors, including your location. Where you choose to spend your golden years is critical.”

The good news? You don’t have to navigate these decisions alone. A trusted real estate advisor in Beverly Hills or Greater Los Angeles can help evaluate your current home’s value, explore local downsizing options, or connect you with agents in other markets if a cross-country move is on the table.

Let’s Turn Your Dream Retirement into a Reality

Whether you’re planning to:

Move closer to your grandkids in the San Fernando Valley

Transition to a luxury condo near the Beverly Hills Hotel

Explore properties in states with no income tax

Sell your current home for top dollar and reinvest wisely

…you deserve a partner who understands both the financial and emotional aspects of real estate in retirement.

Bottom Line

You’ve earned this time. But with the cost of living in Los Angeles and Beverly Hills on the rise, now is the perfect moment to ask: Is my current home helping or holding me back?

Let’s explore how the right move—whether across town or across the country—could elevate your retirement lifestyle while protecting your financial future.

Ready to have that conversation? Reach out today and let’s talk strategy.