Los Angeles & Beverly Hills Luxury Market Update – June 2025: Navigating Rates and Tariffs

The real estate market in Los Angeles and Beverly Hills continues to demonstrate resilience amidst global economic shifts. While mortgage rates have shown minimal change over the past three weeks, local market dynamics are influenced by both global and regional factors. Last week’s inflation data aligned with expectations, causing little reaction among investors. However, the nuanced impact on Los Angeles’ luxury housing market deserves attention. Buyers and sellers in prestigious enclaves like Beverly Hills, Holmby Hills, and Bel Air are particularly sensitive to interest rate adjustments, given the scale of high-value transactions.

The headlines on tariffs and international trade agreements, particularly President Trump’s suggestion to increase tariffs on European Union imports, are creating ripple effects in Los Angeles’s economy. The city’s diverse and globally connected marketplace, including Beverly Hills' luxury retail and entertainment industries, may experience shifts in pricing and supply chains. Moreover, Los Angeles is home to major port facilities that handle international trade, meaning any trade disruptions could impact employment and commercial property dynamics.

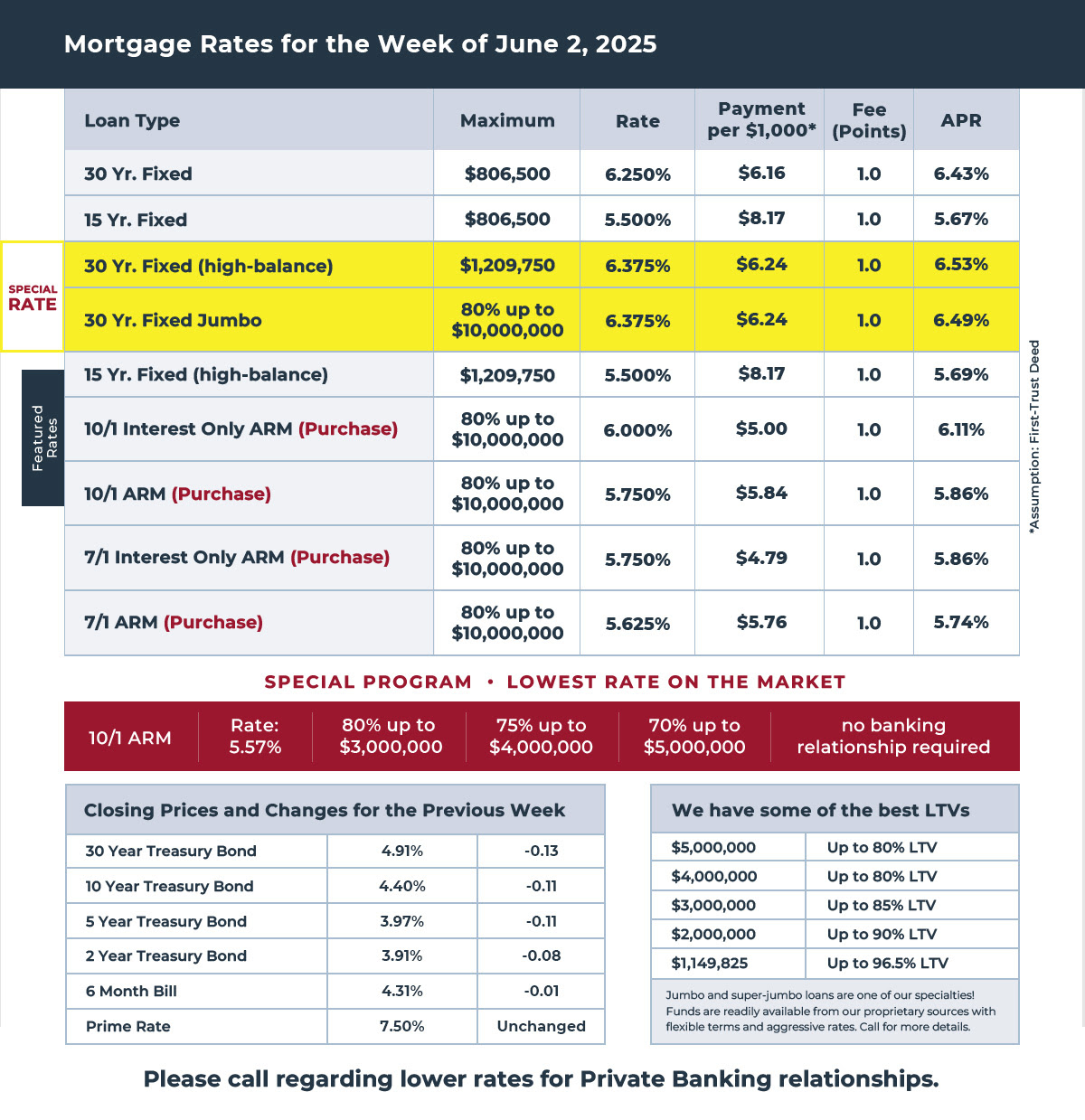

In Beverly Hills, where high-end properties are often financed with jumbo loans, the slight dip in mortgage rates provides a narrow window of opportunity for luxury buyers. According to the latest figures, the 30-year fixed jumbo rate now sits at 6.375%, with an APR of 6.49%. This adjustment, though modest, is significant for estates exceeding $10 million, which are common in neighborhoods like Trousdale Estates, Beverly Park, and The Bird Streets.

Meanwhile, Los Angeles saw a notable rebound in consumer confidence in May, according to the Conference Board index. This recovery signals optimism for local businesses and property owners. Employment prospects and the outlook for the stock market, both crucial to luxury real estate investors, are stabilizing, fueling confidence in high-value residential purchases.

Local investors and agents in Beverly Hills should closely monitor this week’s major economic news, including the ISM manufacturing index, the services sector index, and Friday’s employment report. These indicators are critical for gauging the short-term direction of mortgage rates and overall economic sentiment. Additionally, given the city’s reliance on international buyers, fluctuations in trade tariffs and global economic conditions could influence luxury property demand.

In summary, while the national headlines provide a broad context, Los Angeles and Beverly Hills’s real estate market remains distinctively tied to high-value assets, global economic trends, and the evolving mortgage landscape. Whether you’re looking to purchase a new luxury residence or considering refinancing in the heart of Los Angeles’s premier neighborhoods, now is the time to act with informed confidence.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value