Los Angeles & Beverly Hills Real Estate: A Stable Investment in Volatile Times

If recent volatility in the stock market has you gripping your portfolio a little tighter, you’re not alone. Whether you’re watching your 401(k), crypto assets, or tech stocks, the dramatic daily swings can be nerve-wracking. One day you're up. The next, you're in the red. But if you’re a homeowner in Los Angeles or Beverly Hills, there’s one investment that continues to provide peace of mind: your real estate.

Real Estate is Historically More Stable Than Stocks

According to Investopedia, “Stocks have been far more volatile than real estate.” Yes, the 2008 crash was a rare exception—but that period was driven by irresponsible lending, subprime mortgages, and an oversaturated market. That’s not the situation we’re in today. In fact, many of the most prestigious neighborhoods in Los Angeles—like Bel-Air, Holmby Hills, the Bird Streets, and Beverly Hills Flats—are experiencing record-low inventory and strong buyer demand, keeping home prices stable and often appreciating.

The Numbers Tell the Story

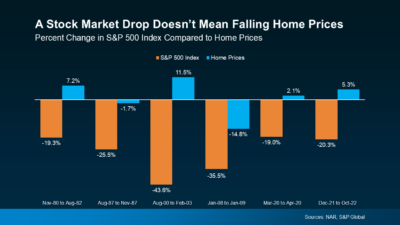

As shown in the first chart, during nearly every major S&P 500 downturn—whether in the early '80s, the Dot-Com bust, or early COVID-19 pandemic—home prices either remained flat or even increased. For instance:

From Aug 2000 to Feb 2003, while the stock market dropped 43.6%, home prices climbed 11.5%.

During the early pandemic (Mar–Apr 2020), stocks fell 19%, but home prices still rose 2.1%.

That pattern is especially true in resilient, luxury-focused markets like Los Angeles, where global demand, lifestyle appeal, and limited land availability insulate values from extreme shifts.

Real Estate vs. Stocks: Volatility Comparison

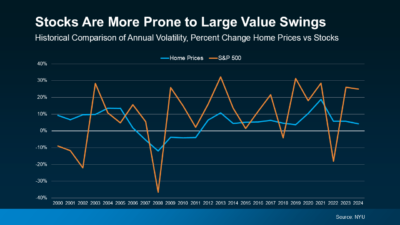

The second graph underscores that point—stock prices routinely fluctuate by 20–30% per year, sometimes more. In contrast, home prices tend to follow a steadier, upward trend. Even during economic downturns, real estate doesn’t exhibit the same roller-coaster dynamics. In Beverly Hills, for example, properties in prime locations such as North of Sunset or Trousdale Estates have continued to hold or increase in value, thanks to buyer confidence and international cachet.

️ A Tangible Hedge Against Uncertainty

Homeownership in Los Angeles is more than a lifestyle—it's a legacy investment. Unlike stocks, your home is a physical asset that provides utility, shelter, tax advantages, and long-term appreciation. It's an asset class that the world’s wealthiest turn to when seeking security.

Bottom Line:

While the stock market reacts to headlines, hype, and algorithms, real estate in Los Angeles and Beverly Hills is rooted in real-world value. If you’re feeling uncertain about your portfolio, take comfort knowing your investment in luxury property is not just beautiful—it's historically resilient.

Thinking about expanding or securing your investment in LA real estate? Let’s connect. I specialize in navigating these markets and helping clients build enduring wealth through real estate.