More Inventory, Less Competition: A Golden Window for LA Luxury Buyers

If you’ve heard that housing inventory is rising nationwide, you’re not alone — and if you're shopping for a luxury home in Los Angeles or Beverly Hills, it may have made you wonder: is this a sign of another crash?

The short answer: no.

Despite the media buzz, the data tells a more nuanced — and encouraging — story. Across Southern California and particularly in elite areas like Beverly Hills, Bel Air, and Holmby Hills, inventory is growing modestly but remains well below historic norms. Instead of signaling trouble, this shift marks a long-overdue return to market stability.

What’s Really Going On With Inventory?

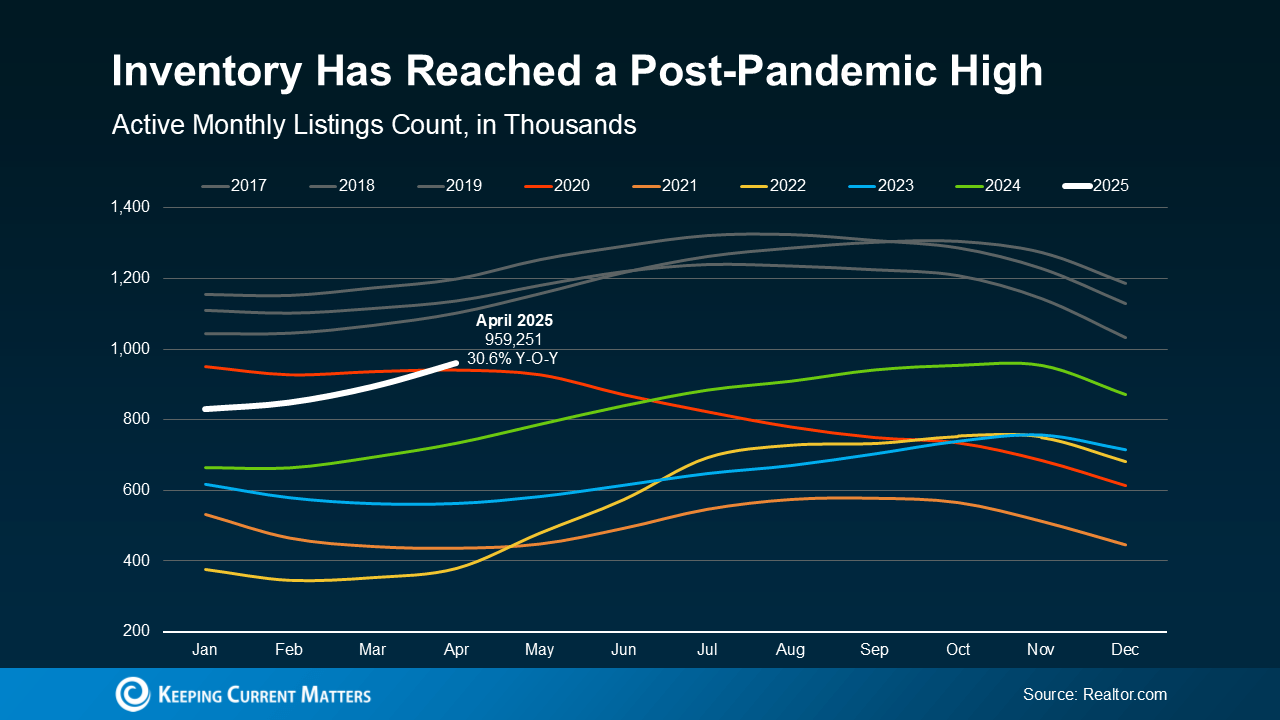

According to Realtor.com, the number of active listings across the U.S. in April 2025 reached 959,251 — a 30.6% increase year-over-year, and the highest level since 2020. (See Chart 1 )

But here’s the crucial context: while inventory is rising, we’re still not back to pre-pandemic levels — not nationally, and definitely not in high-demand enclaves like Los Angeles’ Westside.

In Beverly Hills, inventory remains tight, especially in the ultra-luxury segment ($10M+), where demand continues to outpace supply. We’re seeing more listings come online, but that’s a response to buyer demand — not an oversupply problem.

️ Why This Is Not 2008 All Over Again

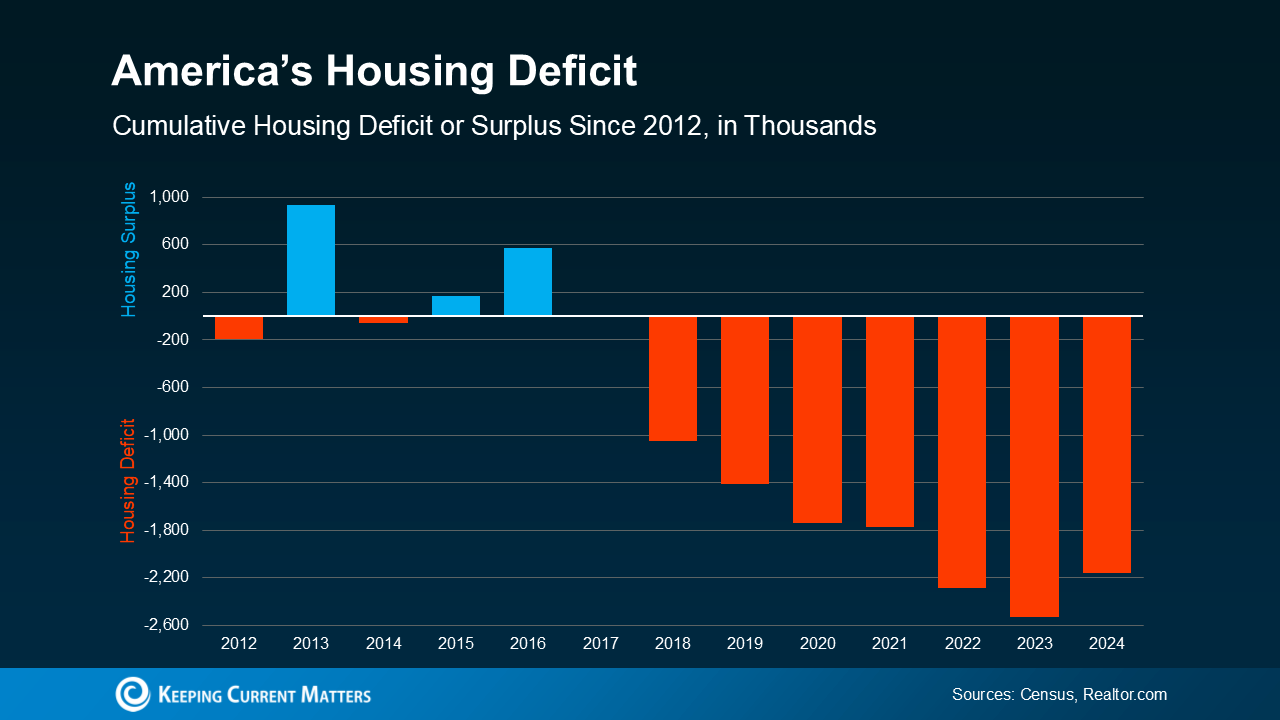

The 2008 crash was driven by a flood of inventory paired with loose lending and speculative buying. Today, we’re facing the opposite — a structural housing shortage years in the making.

Take a look at Chart 2 — America’s cumulative housing deficit shows we’ve been underbuilding since 2012. By 2024, we were short by well over 2 million homes. That deficit is particularly acute in cities like Los Angeles, where strict zoning, limited land, and permitting delays have long stifled new construction.

As Realtor.com notes:

“At a 2024 rate of construction relative to household formations and pent-up demand, it would take 7.5 years to close the housing gap.”

What This Means for Buyers and Sellers in Los Angeles and Beverly Hills

-

Buyers: Rising inventory offers more options, especially in the mid- to high-luxury tiers. While you still need to act quickly in the ultra-competitive $2M–$7M range, you may find more flexibility on price and terms than in previous years.

-

Sellers: More listings mean more competition. Now more than ever, you need a seasoned expert — a top Beverly Hills real estate agent — to strategically position your property with compelling marketing, accurate pricing, and global reach.

In areas like the Beverly Hills Flats, Trousdale Estates, and the Bird Streets, demand remains strong, especially for move-in ready or architecturally significant properties. If you’re selling, this is an opportunity to stand out — not sit back.

Bottom Line

The rise in active listings isn’t a warning sign of a crash — it’s a sign of a maturing, more balanced housing market. Especially in markets like Los Angeles and Beverly Hills, rising inventory is helping meet years of pent-up demand— not flooding the market.

If you're thinking about buying or selling in today's evolving market, let's connect. With over 36 years of experience and deep expertise in luxury real estate Los Angeles, I’ll guide you with precision, strategy, and unparalleled results.