Mortgage Forbearance: A Lifeline for Homeowners Facing Financial Challenges in Los Angeles and Beverly Hills, CA

Mortgage Forbearance: A Lifeline for Homeowners Facing Financial Challenges in Los Angeles and Beverly Hills, CA

Life can be unpredictable, and even in the affluent neighborhoods of Los Angeles and Beverly Hills, financial challenges can arise unexpectedly. Whether due to job loss, sudden expenses, or natural disasters, homeowners sometimes find themselves in a tough spot. Fortunately, mortgage forbearance remains a vital option to provide relief during challenging times.

What Is Mortgage Forbearance?

Mortgage forbearance allows homeowners to temporarily pause or reduce their mortgage payments during a financial crisis. Bankrate defines it as:

“. . . an option that allows borrowers to pause or lower their mortgage payments while dealing with a short-term crisis, such as a job loss, illness, or other financial setback . . . When you can’t afford to pay your mortgage, forbearance gives you a chance to sort out your finances and get back on track.”

While many associate forbearance with the COVID-19 pandemic, it remains available for homeowners today, offering a critical safety net for those facing temporary financial struggles. For residents in high-value areas like Beverly Hills, this option can help maintain ownership of luxury properties and avoid foreclosure, which could significantly impact home values and equity.

The Current State of Mortgage Forbearance

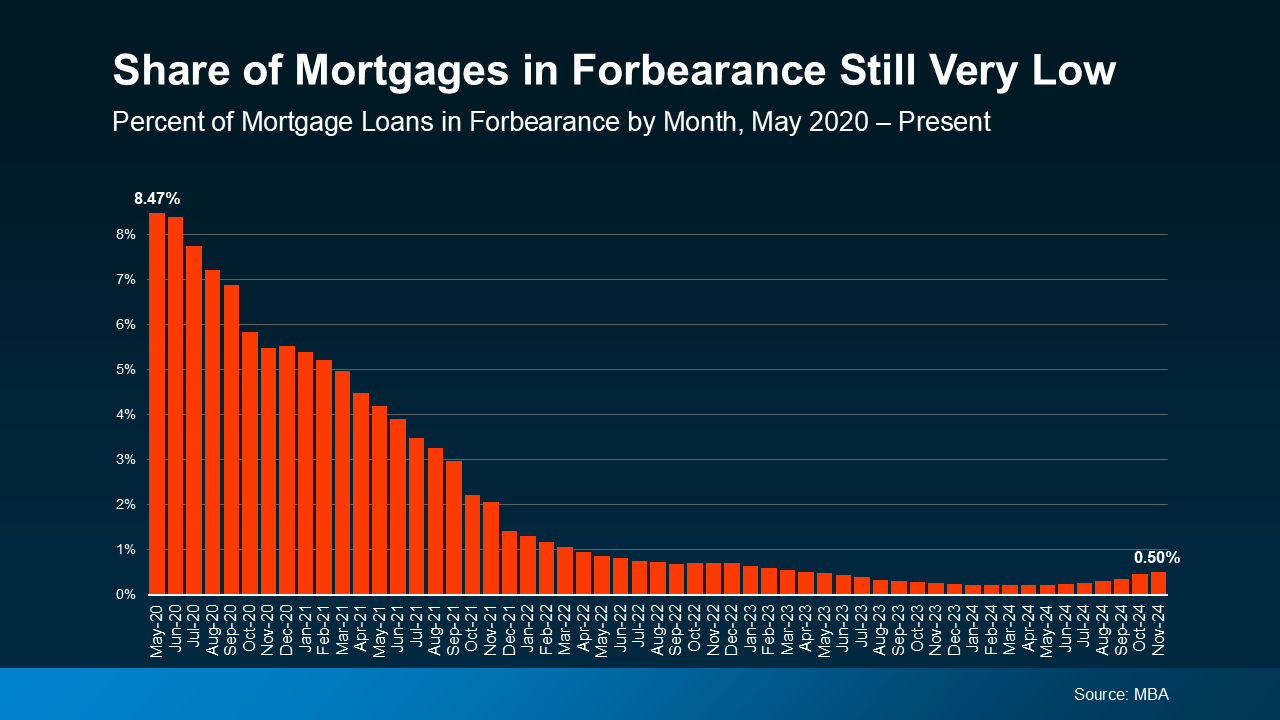

Although the overall mortgage forbearance rate has seen a slight rise recently, it remains far below its pandemic-era peak. According to Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association (MBA):

“The overall mortgage forbearance rate increased three basis points in November and has now risen for six consecutive months.”

This recent uptick is largely tied to natural disasters like hurricanes, which have created temporary hardships for affected homeowners. Thankfully, only a small percentage of mortgages nationwide are currently in forbearance. This stability reflects the strong foundations of today’s housing market, even in luxury enclaves such as the Westside of Los Angeles.

For properties in Beverly Hills and Bel Air, where home equity often serves as a financial buffer, forbearance can still provide an important fallback for those facing unforeseen challenges.

Why Forbearance Matters in Los Angeles’ Luxury Market

Forbearance allows homeowners to avoid the downward spiral of missed payments and foreclosure, offering breathing room to recover from financial setbacks. In neighborhoods where home values consistently appreciate — such as Los Angeles and Beverly Hills — avoiding foreclosure is critical to preserving the value of your investment.

Even with rising interest rates and property taxes, many homeowners in the area are sitting on significant equity, thanks to the steady appreciation of luxury real estate. This equity often reduces the need for forbearance, but the option remains essential for those experiencing temporary hardships.

If you’re a homeowner facing financial difficulties, the first step is to contact your mortgage lender. They’ll guide you through the application process and help determine the best course of action. Remember, forbearance is not automatic; it requires communication and agreement with your lender.

Bottom Line

In high-stakes markets like Los Angeles and Beverly Hills, mortgage forbearance can serve as a powerful lifeline, ensuring that temporary financial setbacks don’t result in losing your home. Whether you own a classic Beverly Hills estate or a contemporary hillside property in Bel Air, this option offers peace of mind in uncertain times. If you’re navigating financial difficulties or curious about your options, reach out to a trusted real estate professional or your mortgage lender for guidance.

Let’s connect to discuss strategies to safeguard your home and your financial future in the dynamic Los Angeles luxury real estate market. 🏡✨