Mortgage Rates Are Stabilizing – What That Means for Los Angeles and Beverly Hills Buyers

Over the past few years, housing affordability has been one of the biggest challenges for buyers—especially in high-demand luxury markets like Los Angeles and Beverly Hills. With home prices steadily rising and mortgage rates reaching multi-year highs, many prospective buyers have found themselves waiting on the sidelines, unsure of their next move.

But there’s good news: mortgage rates have recently shown signs of stabilizing, giving savvy buyers in markets like Beverly Hills and Westside Los Angeles a rare window of predictability. And in a luxury market, certainty is power.

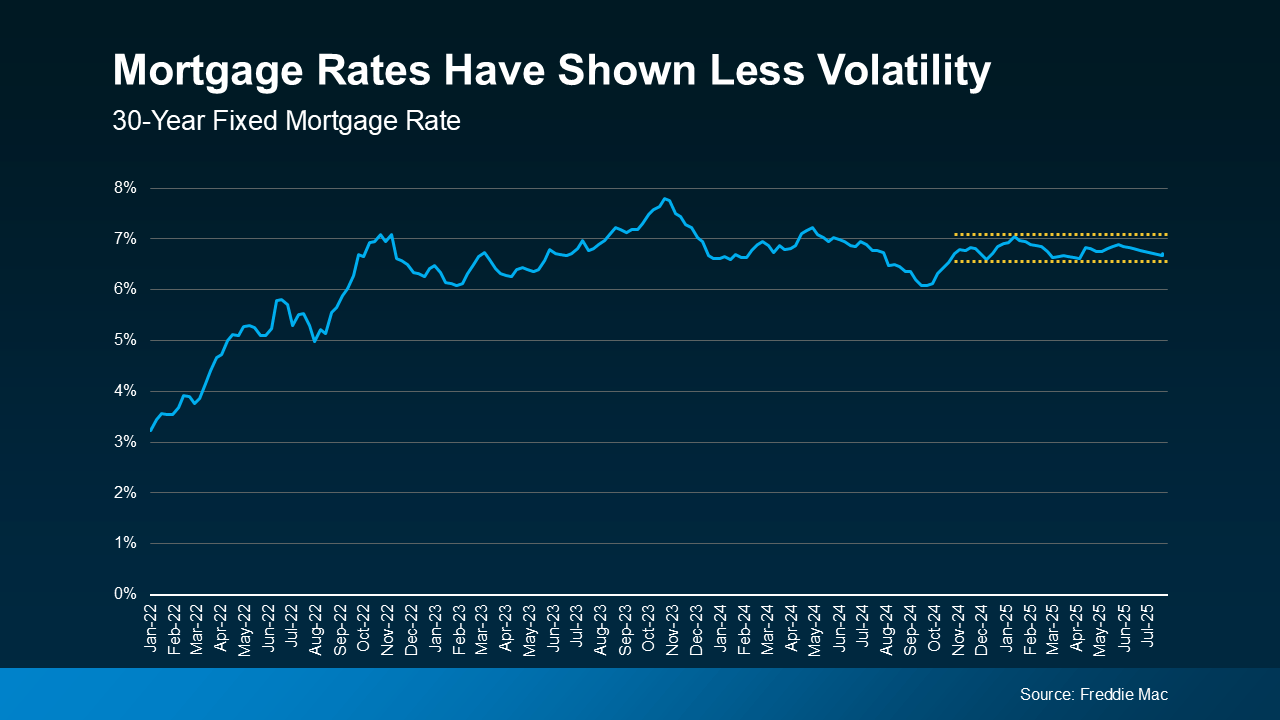

Mortgage Rates Have Settled into a Narrow Range

Over the last year, we saw mortgage rates fluctuate significantly, which made financial planning challenging for many. However, as illustrated by Freddie Mac’s latest data, rates have remained between roughly 6.5% and 7% since late 2024. These relatively small shifts mark one of the calmest stretches in recent mortgage history.

As HousingWire reports:

“Analysts, economists, and mortgage professionals are coining this quarter’s activity as one of the most 'calm' periods for mortgage rates in recent memory.”

That’s especially impactful in luxury markets like Beverly Hills, where multimillion-dollar transactions hinge on even fractional changes in mortgage costs.

How Mortgage Stability Helps Beverly Hills and Los Angeles Buyers

In high-value markets, clarity is key. When rates are volatile, it’s hard to know what your monthly mortgage payment will look like, even with pre-approval. But with rate stability, luxury buyers can now run projections more confidently—and take advantage of new inventory without hesitation.

Whether you're shopping for a $5M home in Bel Air or a $20M estate in the Beverly Hills Flats, this predictability makes it easier to plan a strategic purchase.

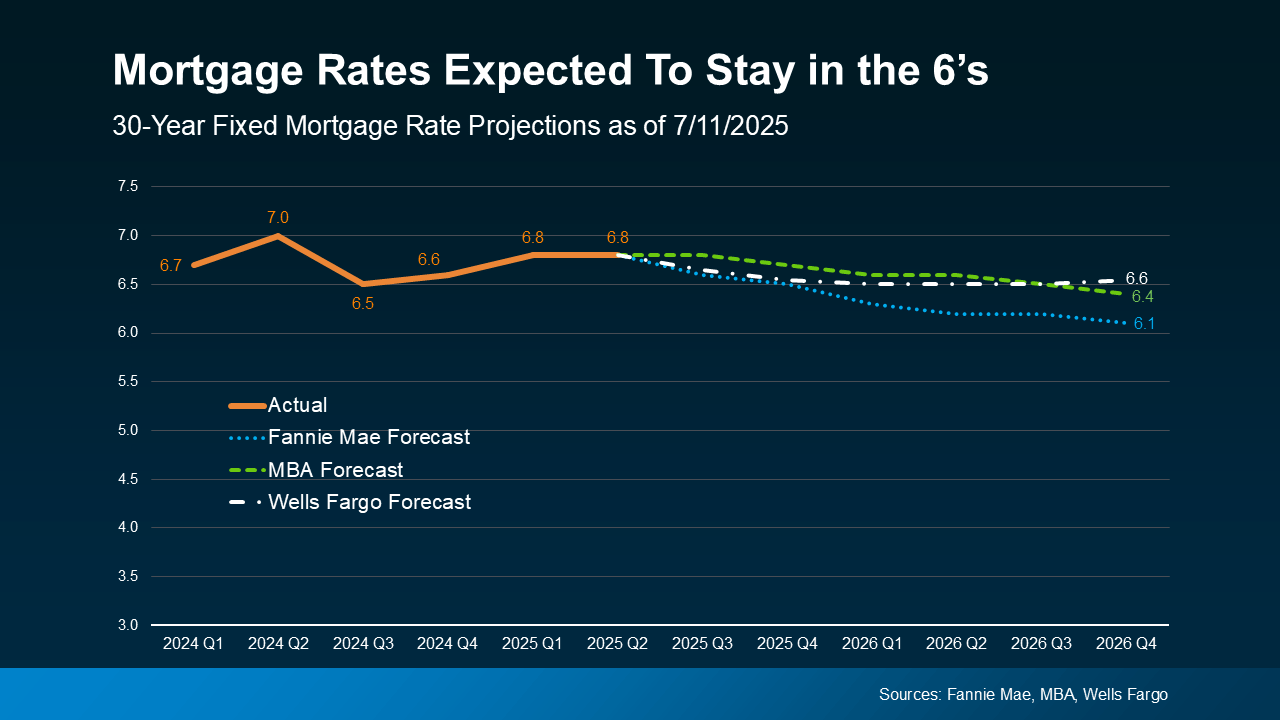

Will This Stability Last?

Most economists agree: rates are likely to stay in the 6% range through at least 2026. Fannie Mae, MBA, and Wells Fargo all project a gradual, not dramatic, decline in rates (see chart). Danielle Hale, Chief Economist at Realtor.com, notes:

“I expect a generally downward trend for rates this year, but at a slow enough pace that it might not be noticeable in any given month.”

In other words, waiting for 5% may leave you on the sidelines far too long. As Jeff Ostrowski of Bankrate puts it:

“Trying to time mortgage rates is really difficult. There’s no guarantee that rates are going to be any more favorable in three months or six months.”

What This Means for Luxury Buyers in LA

If you’ve been waiting to buy a luxury property in Beverly Hills, Holmby Hills, Bel Air, or the Sunset Strip, this could be the opportunity you’ve been waiting for:

-

Rate stability gives you clarity.

-

Improving inventory opens more doors.

-

Slower price appreciation means less competition and more negotiation room.

As Freddie Mac’s Chief Economist, Sam Khater, explains:

“Rate stability, improving inventory, and slower house price growth are an encouraging combination . . .”

Bottom Line

While affordability remains a challenge, the recent calm in mortgage rates is offering a moment of clarity for luxury homebuyers in Los Angeles. Whether you're looking for a hillside contemporary in Bird Streets or a gated villa in Beverly Park, now may be your chance to secure your dream home with confidence.

Let’s connect today to run your numbers and review available luxury properties. As a top agent in Beverly Hillswith over 36 years of experience, I’m here to help you navigate this market strategically and successfully.