Mortgage Rates Just Saw Their Biggest Drop in a Year – What It Means for Los Angeles and Beverly Hills Buyers

Mortgage Rates Just Saw Their Biggest Drop in a Year – What It Means for Los Angeles and Beverly Hills Buyers | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert

You’ve been waiting for what feels like forever for mortgage rates to finally budge. And last week, they did – in a big way.

On Friday, September 5th, the average 30-year fixed mortgage rate fell to the lowest level since October 2024. It was the biggest one-day decline in over a year, giving buyers and sellers across Los Angeles reason to pay attention.

What Sparked the Drop?

According to Mortgage News Daily, this was a reaction to the August jobs report, which came out weaker-than-expected for a second month in a row. That signaled a slowdown in the broader economy, and financial markets responded quickly. Historically, when uncertainty grows about economic strength, mortgage rates trend downward—and that’s exactly what happened.

Why This Matters for Los Angeles and Beverly Hills

In high-value markets like Los Angeles, Beverly Hills, and the surrounding Platinum Triangle neighborhoods, small changes in rates have an outsized impact.

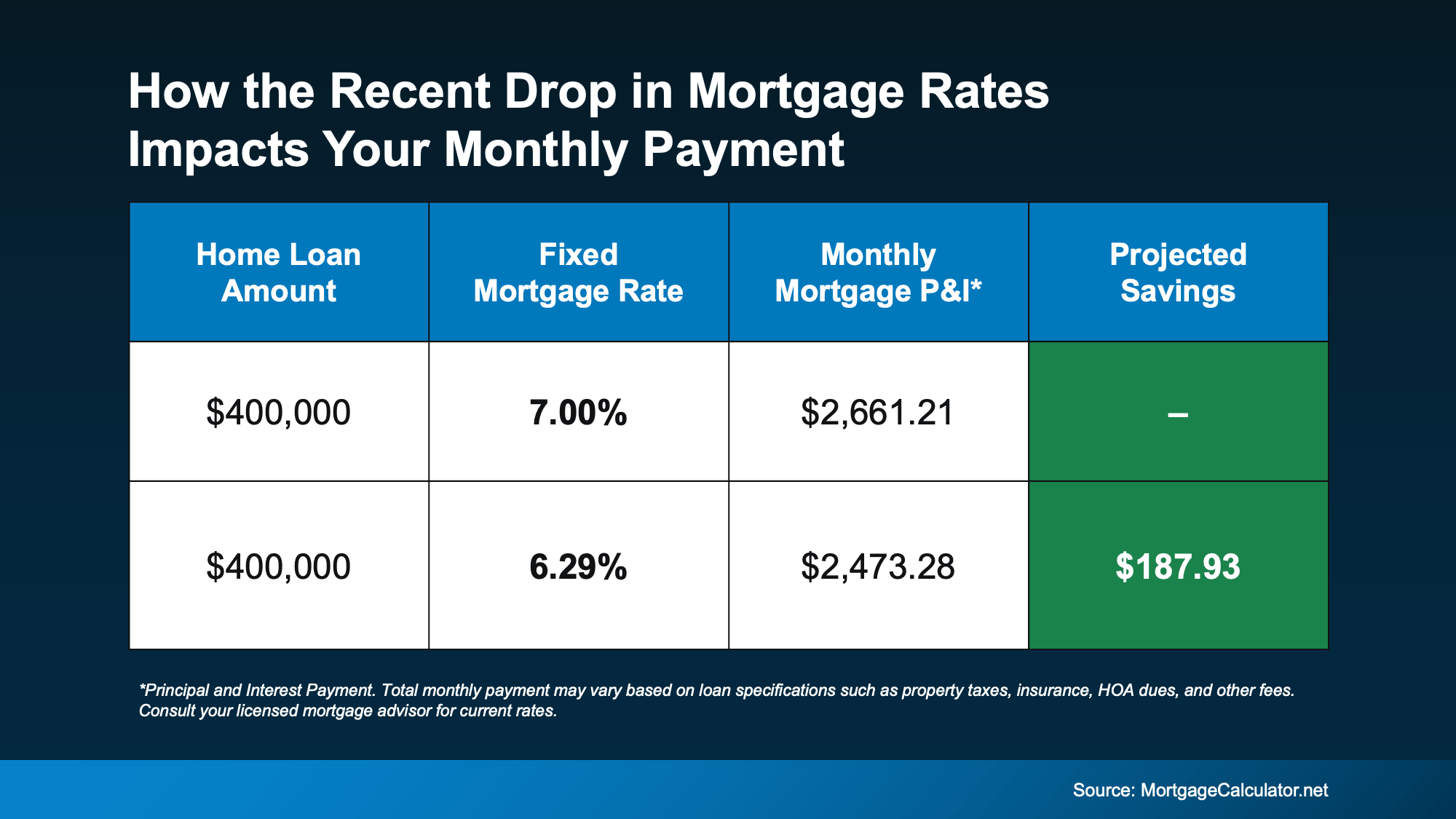

For example:

-

A $400,000 loan dropping from 7.00% to 6.29% saves nearly $200 per month, or about $2,400 per year.

-

Now scale that to luxury loan amounts. On a $3,000,000 mortgage (a common figure in Beverly Hills or Bel Air), the savings can exceed $1,400 per month—over $17,000 per year.

That kind of shift can make the difference between a buyer sitting on the sidelines or moving forward on a purchase in neighborhoods like Beverly Hills Flats, Holmby Hills, or the Bird Streets.

How Long Will It Last?

That depends on where the economy and inflation go from here. Rates could continue to ease if economic data keeps pointing toward a slowdown, or they could inch back up if inflation pressures return.

For Beverly Hills and Los Angeles sellers, this window could be a powerful advantage. Lower rates widen the buyer pool and give luxury buyers greater purchasing power. For buyers, this is an opportunity to lock in a rate before market conditions change.

Local Perspective

In Los Angeles, particularly in the $5M–$30M range, demand has been tempered over the past year by rate volatility and global economic uncertainty. But as financing becomes more affordable—even at the upper end of the market—buyers who were hesitant are beginning to re-engage. Properties that once felt out of reach are now realistic options.

In Beverly Hills, where buyers are often highly sophisticated and globally connected, even incremental rate drops make a psychological impact. The perception of a “turning point” in the market can drive renewed activity, especially in trophy properties or architecturally significant estates.

Bottom Line

Mortgage rates just saw their biggest decline in over a year. For Los Angeles and Beverly Hills real estate, this shift could open doors—literally and figuratively—for buyers who have been waiting.

If rates stay near this level, a home that felt unattainable just months ago may suddenly fit within your budget. Whether you’re buying or selling in Beverly Hills, Bel Air, Holmby Hills, or Los Feliz, this change could mark the beginning of a new chapter in the market.

What would today’s rates save you on your future monthly payment? Let’s connect and run the numbers.