Recession Doesn’t Equal Housing Crisis: What Los Angeles Buyers and Sellers Need to Know

With increasing talk of a possible recession, many buyers and sellers in Los Angeles and Beverly Hills are understandably wondering: What would a recession mean for the housing market? Does economic uncertainty automatically lead to falling home values or rising mortgage rates?

The short answer is: not necessarily. And the data makes that very clear.

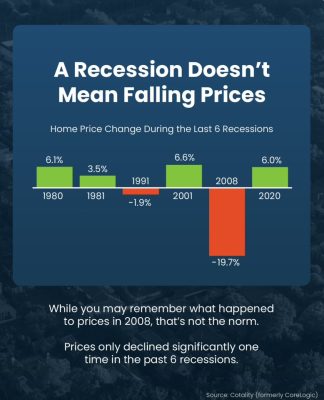

A Recession Doesn’t Mean Home Prices Will Fall

Let’s start with a common fear among homeowners and sellers: that a recession leads to a housing crash. While the 2008 financial crisis is still fresh in many minds—and was undeniably severe—it was a rare outlier. Looking back at the last six U.S. recessions (1980, 1981, 1991, 2001, 2008, and 2020), home prices declined significantly only once: during the 2008 crash, when prices dropped by nearly 20%.

In all the other five recessions, home values either remained stable or appreciated—with increases ranging from 3.5% to 6.6%. That means historically, real estate has remained a strong, stable investment during economic downturns.

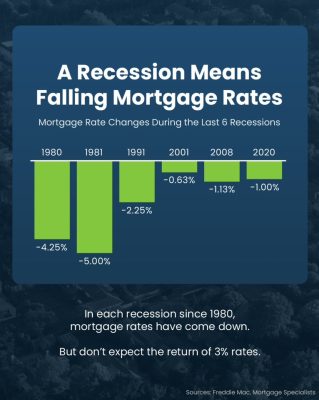

Mortgage Rates Typically Drop During Recessions

Buyers often worry that higher interest rates will make purchasing a home less affordable. However, one consistent pattern across all six of the past recessions is that mortgage rates have fallen. In 1980, rates dropped by over 4%. In 1991, they fell by 2.25%. Even during the brief pandemic recession of 2020, rates came down by about 1%.

Lower interest rates can increase buyer demand and affordability—especially in competitive high-end markets like Beverly Hills, Bel-Air, Brentwood, and Holmby Hills. However, it’s important to be realistic: we’re not expecting a return to ultra-low 3% rates anytime soon. But we are likely to see a softening in rates as inflation cools and economic pressures persist.

Why This Matters for Los Angeles and Beverly Hills Real Estate

The Los Angeles luxury real estate market operates in its own ecosystem, often buffered by global demand, limited inventory, and affluent buyers who purchase in cash or with strategic financing. That’s why we’re not seeing distressed sales or deep price cuts in prime neighborhoods like Beverly Hills Flats, the Bird Streets, or the Sunset Strip.

If you’re a seller, the message is: don’t panic. A possible recession does not mean your property value will collapse. The key is to price strategically based on current buyer demand and to work with an experienced local real estate expert who understands the nuances of the high-end market.

If you’re a buyer, this could be your window of opportunity. As mortgage rates begin to ease and competition stabilizes, now may be the perfect time to make your move—especially before prices climb further in the long term.

Bottom Line

Despite what headlines may suggest, a recession does not equal a housing crisis. Historical data shows that home prices have remained strong in most recessions and mortgage rates have typically decreased, creating favorable buying conditions.

Whether you're buying or selling in Los Angeles or Beverly Hills, staying informed is your best strategy. I’m here to help you navigate this market with clarity, confidence, and expertise.

Have questions about your real estate goals? Let’s connect.