The Housing Market Is Turning a Corner Going Into 2026

The Housing Market Is Turning a Corner Going Into 2026 | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert

After several years of higher mortgage rates and a cautious buyer pool, the housing market is finally shifting in a meaningful way. The energy is subtle—but unmistakable. Sellers are reappearing. Buyers are getting off the sidelines. And momentum is beginning to build as we head toward 2026.

It’s not a tidal wave. But it is a turning point. And in markets like Los Angeles and Beverly Hills—where timing and confidence matter enormously—this shift could have real impact.

Here are the three macro trends driving the national comeback, and what they mean specifically for our high-end LA markets.

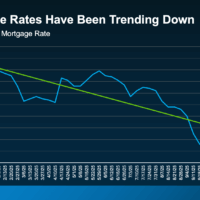

1. Mortgage Rates Have Been Trending Down

Rates have always moved in cycles, especially in periods of economic uncertainty. But if you take the long view, the story becomes clear: 2025 has delivered a steady, downward trend in mortgage rates.

(Insert your first chart here: “Mortgage Rates Have Been Trending Down”)

In the last few months alone, buyers have enjoyed the best rates of the year. According to Sam Khater, Chief Economist at Freddie Mac:

“On a median-priced home, this could allow a homebuyer to save thousands annually compared to earlier this year, showing that affordability is slowly improving.”

This change is significant. It means lower borrowing costs, more purchasing power, and renewed enthusiasm—especially in Los Angeles, where many high-net-worth buyers choose to finance strategically rather than pay cash.

A key example:

Redfin reports that a buyer with a $3,000 monthly mortgage budget can now afford about $25,000 more home than they could one year ago.

What This Means for Los Angeles and Beverly Hills

In the luxury segment, even a small rate shift can affect a buyer’s decision-making psychology. And right now, I’m seeing:

-

More showing requests from international buyers, especially from Asia and the Middle East.

-

Move-up buyers revisiting opportunities they paused on in 2024.

-

Local families exploring Beverly Hills, Holmby Hills, and Bel Air again, thanks to improved financing flexibility.

Rates don’t have to be “low”—they just need to be moving in a favorable direction. And they are.

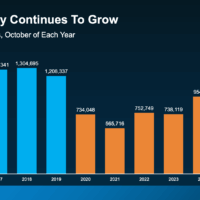

2. More Homeowners Are Ready to Sell

For years, inventory was frozen in place. Homeowners didn’t want to give up their historically low mortgage rates—a phenomenon known as the lock-in effect. But as rates ease and life events take priority, more sellers are re-entering the market.

(Insert your second chart here: “Inventory Continues to Grow”)

Realtor.com data shows October inventory has climbed steadily, approaching levels we haven’t seen in almost six years.

Why This Matters

A rising inventory not only creates more balance—it also boosts buyer confidence. Greater choice means buyers are more likely to engage.

What This Means for Beverly Hills and LA

This trend is especially notable in our prime neighborhoods:

-

Beverly Hills Flats is seeing more turnover than it has since pre-pandemic years.

-

Bel Air and Holmby Hills show a slow but steady rise in new listings—particularly architecturals and estate properties.

-

Los Feliz and Hancock Park inventory has stabilized, bringing qualified buyers back out.

The ultra-luxury market (above $20M) is still selective, but choice is expanding—and that alone creates movement.

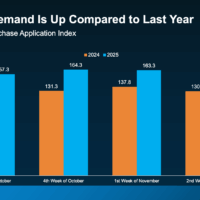

3. Buyers Are Re-Entering the Market

With more inventory and better affordability, buyer demand is rising again. The Mortgage Bankers Association shows purchase application activity is up compared to last year.

(Insert your third chart here: “Buyer Demand Is Up Compared to Last Year”)

This uptick is happening nationally—and LA is always ahead of national trends.

What I’m Seeing Locally

Across the Westside luxury market:

-

High-intent buyers are returning to property tours in Beverly Hills, Bel Air, and Brentwood.

-

International buyers are more active, particularly for trophy estates and iconic architecture.

-

Well-priced listings are selling faster, with fewer days on market than in early 2024.

And major forecasting groups—Fannie Mae, MBA, and NAR—expect continued, moderate sales growth into 2026.

This won’t be an explosive surge. But it is a steady, confident re-entry of buyers into the market.

Bottom Line

After a few slower years, the housing market is finally turning the corner.

Lower mortgage rates, rising inventory, and renewed buyer activity are all pointing toward a stronger, more balanced market in 2026.

And here in Los Angeles—where global wealth, lifestyle demand, and architectural scarcity drive long-term value—the opportunity is even more compelling.

If you're considering buying or selling in Beverly Hills, Bel Air, Holmby Hills, Los Feliz, or anywhere across the LA luxury landscape, now is the moment to prepare.

Let’s connect and discuss how you can strategically position yourself for success in 2026.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value