Think It’s Better To Wait for a Recession Before You Move? Think Again – Especially in Los Angeles & Beverly Hills

With recession talk back in the headlines, many prospective homebuyers and sellers in Los Angeles and Beverly Hills are wondering if now is the right time to make a move — or if they should wait it out. According to a recent study from John Burns Research and Consulting and Keeping Current Matters, a significant 68% of people are delaying their real estate plans due to economic uncertainty.

But the hesitation isn’t always rooted in fear. In fact, many potential buyers see a recession as an opportunity. Realtor.com reports that nearly 30% of surveyed homebuyers said they’d be more likely to purchase a home during a recession. Why? Because historically, recessions often bring lower mortgage rates. And that’s not just a theory — it’s a trend backed by data.

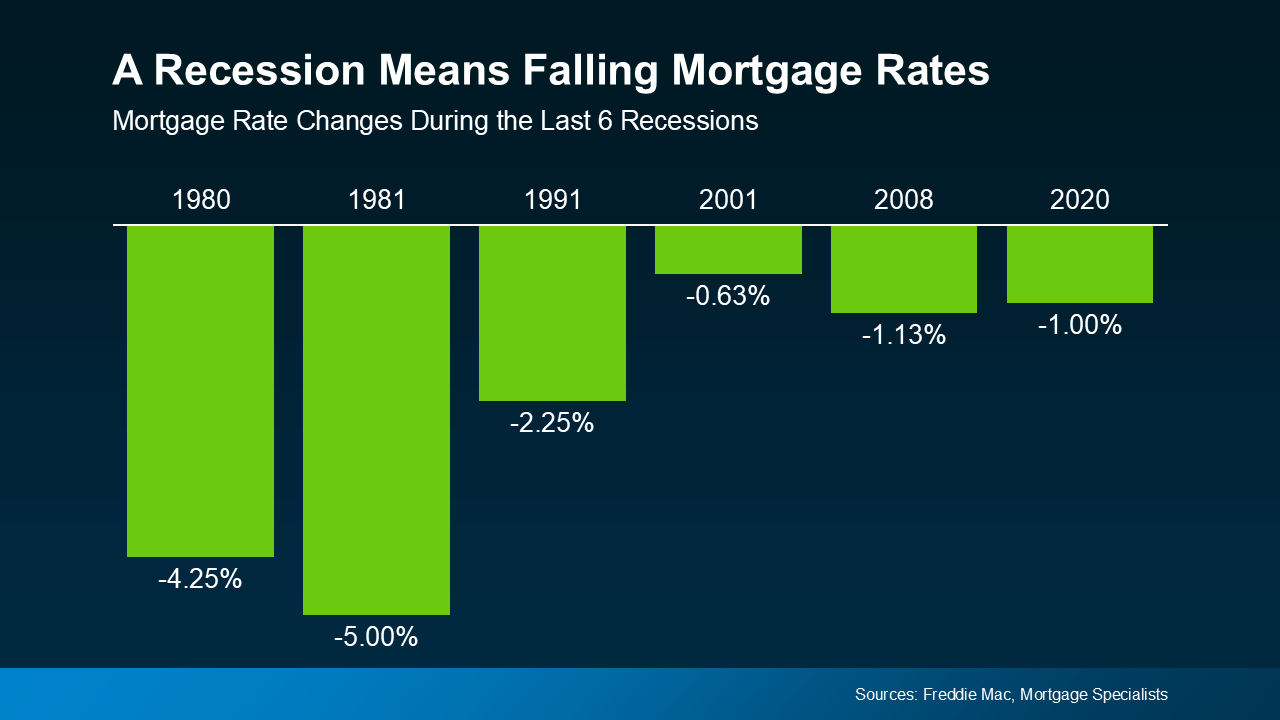

Mortgage Rates Tend to Fall During Recessions

As shown in the chart below (from Freddie Mac), mortgage rates have declined during the last six U.S. recessions. In 1981, rates dropped a whopping 5.00%, and even in the 2020 pandemic-induced recession, they fell by 1.00%. That kind of rate drop can dramatically improve affordability, especially in high-priced markets like Beverly Hills, Bel Air, or West Hollywood.

But here's where many hopeful buyers may be miscalculating...

Home Prices Don’t Typically Fall in Recessions — Especially Not in Prime LA Neighborhoods

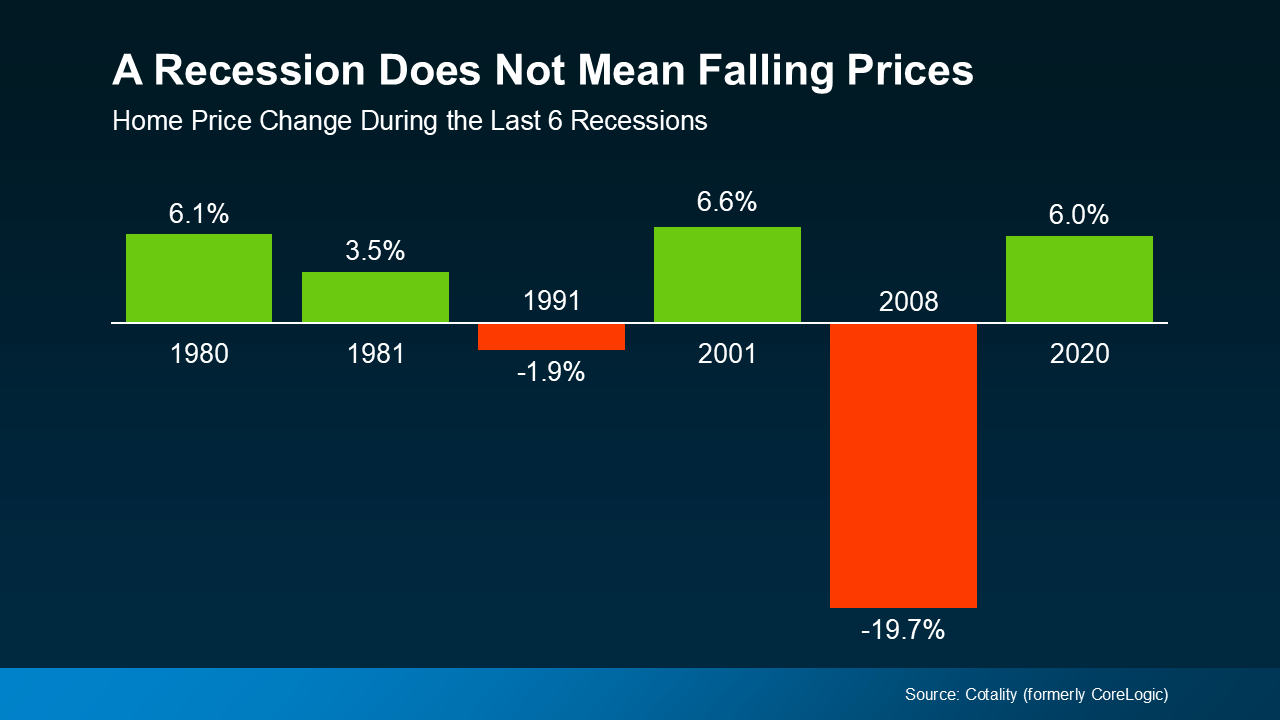

Contrary to popular belief, a recession doesn’t automatically trigger home price declines. The graph below (based on data from Cotality, formerly CoreLogic) shows that in four of the last six recessions, home prices actually increased. The only major dip was in 2008 during the housing crash — a unique event caused by mortgage market failures, not just an economic slowdown.

In Beverly Hills and the broader Los Angeles luxury market, prices are still holding firm — and in many cases, rising. Tight inventory, international demand, and the allure of lifestyle-rich enclaves mean buyers shouldn’t expect dramatic price drops. As Robert Frick of Navy Federal Credit Union explains:

“Hopes that an economic slowdown will depress housing prices are wishful thinking at this point.”

What This Means for You as a Buyer or Seller in LA or Beverly Hills

If you're hoping a potential recession will make homes cheaper, the data suggests otherwise. Waiting might result in lower mortgage rates — but you’ll also be competing with a flood of buyers who jump back in the moment rates dip. This could drive up prices or reduce your negotiating power.

On the flip side, if you’re selling a home in Beverly Hills, Bel Air, Holmby Hills, or West Hollywood, there’s no reason to wait. High-end homes in these areas continue to perform well — especially when marketed by an expert who understands the unique psychology of luxury buyers and how to position your property globally.

✅ Bottom Line

Recessions often lead to lower mortgage rates — but not necessarily lower home prices. In Los Angeles and Beverly Hills, real estate remains a valuable asset, buffered by lifestyle appeal, limited inventory, and strong global demand.

If you're thinking of buying or selling, don’t wait for a "perfect market" that may never come. Let’s connect and craft a strategy tailored to your goals — whether you're moving up, scaling down, or investing in one of the world’s most iconic markets.

Christophe Choo | Beverly Hills Top Agent | Coldwell Banker Global Luxury

Representing Luxury Real Estate in Beverly Hills, Bel Air, Holmby Hills, & Westside Los Angeles

36+ Years of Proven Success

Let’s talk: (310)777-6342