Under 6% Mortgage Loans Are Back! Why Now Is the Sweet Spot for Buying or Refinancing Luxury Real Estate in LA.

Under 6% Loans Are Back! Why Now Is the Sweet Spot for Buying or Refinancing Luxury Real Estate in LA

Here’s something we haven’t been able to say in a long time:

You can now lock in a mortgage rate below 6% on high-balance and select jumbo loans.

That’s huge news for buyers, sellers, and current homeowners — especially in the luxury markets of Beverly Hills, Bel Air, Holmby Hills, and Westside Los Angeles.

What’s Driving This Opportunity?

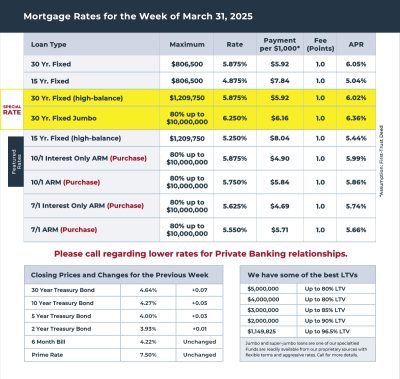

Even with a slight uptick last week, mortgage rates remain near their lowest levels of 2025. According to the latest data:

30-Year Fixed (High-Balance Loans) up to $1,209,750:

5.875% Rate | 6.02% APR

15-Year Fixed (High-Balance Loans):

5.25% Rate | 5.44% APR

Jumbo Loans (Up to $10M):

6.25% Rate | 6.36% APR

Inflation ticked up slightly (Core PCE at 2.8%), but the Fed has kept rates stable and the bond market continues to support attractive loan pricing — especially for buyers with excellent credit and luxury loan profiles.

For Buyers: This Is a Power Move

With luxury mortgage rates dipping below 6%, this is your chance to:

Secure a larger property with a better payment

Lock in financing before further inflation causes upward pressure on rates

Take advantage of rising inventory while still enjoying competitive terms

And with home prices rising 4% in February and inventory still extremely low, waiting could mean paying more for less.

For Sellers: More Buyers = More Leverage

When rates drop, serious buyers re-enter the market. As a seller, this creates:

Stronger demand for your home

A better chance of multiple offers

A chance to close before potential rate hikes cool things down

If you're sitting on the fence about listing — this is a window worth capitalizing on.

For Homeowners: Refinancing Makes Dollars and Sense

Still paying over 6%?

You're potentially losing thousands each year in interest.

Refinancing now can:

Lower your monthly payment

Reduce your total loan cost

Tap into equity at a favorable rate for renovations or investments

Bonus Insight: The Housing Market Is Gaining Steam

February housing starts jumped 11%

Existing home sales up 4% month-over-month

Inventory remains tight at just 3.5 months of supply nationally

Homebuilder confidence is down due to rising costs — but buyer demand is steady

All signs point to a market that's moving — not crashing.

Let’s Make the Numbers Work for You

Whether you're buying, selling, or just running the numbers on a refinance, I’m here to give you the facts, the strategy, and the luxury service you deserve.

Let’s talk now while rates are still working in your favor.