What Credit Score Do You Really Need To Buy a Home in Los Angeles or Beverly Hills?

When it comes to buying a home in Beverly Hills or anywhere across Los Angeles, most buyers are in the dark about what credit score they actually need. In fact, according to Fannie Mae, nearly 90% of buyers overestimate the credit score required to qualify for a mortgage.

And in a competitive market like Beverly Hills—where luxury homes often come with multi-million-dollar price tags—this misunderstanding can create unnecessary fear or hesitation. But here’s the truth: your credit score doesn’t have to be perfect to buy a home, even in one of the most desirable real estate markets in the world.

There’s No Magic Number—And That’s Good News

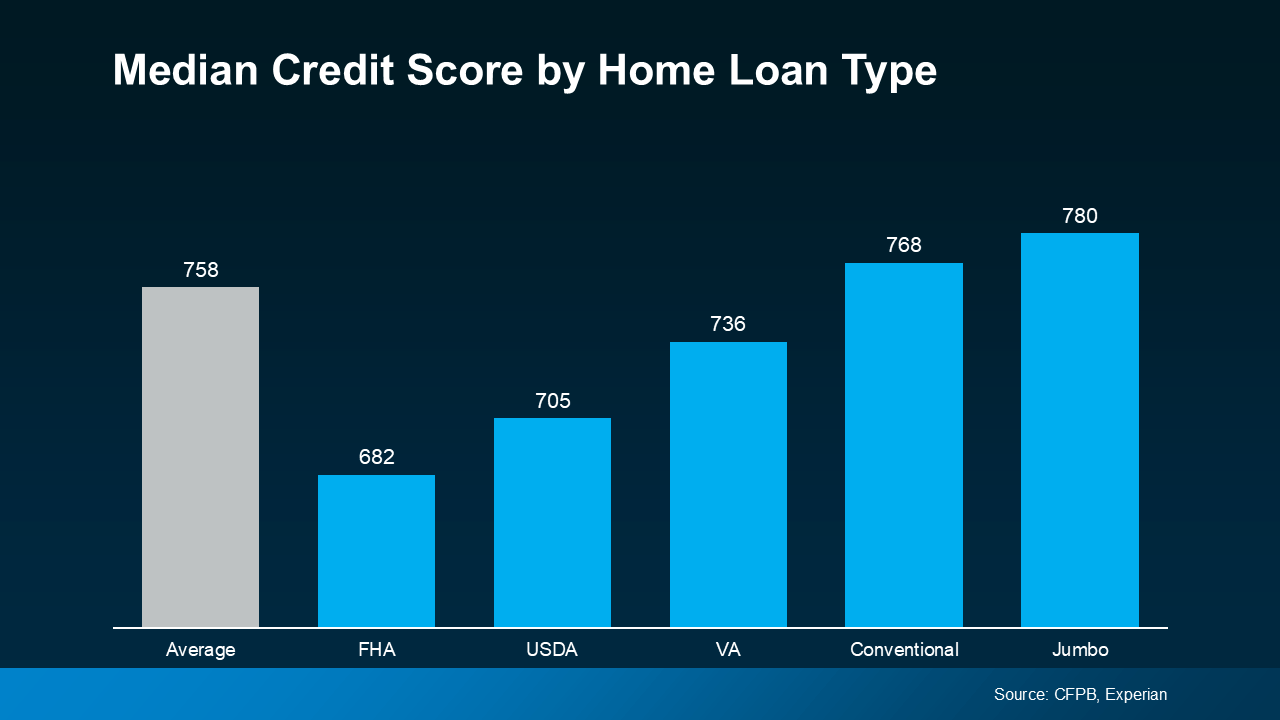

There’s no universal credit score that guarantees mortgage approval. Lenders use a range of scores depending on the type of loan, your financial profile, and the property you’re looking to buy. Here's a look at the median credit scores by loan type:

-

FHA Loans – Median Score: 682

-

USDA Loans – Median Score: 705

-

VA Loans – Median Score: 736

-

Conventional Loans – Median Score: 768

-

Jumbo Loans – Median Score: 780

In luxury markets like Beverly Hills and Bel-Air, Jumbo loans are common, which generally require higher credit scores. However, if you’re a first-time buyer or looking for a starter property in areas like Westwood, Beverlywood, or Culver City, an FHA or VA loan might be a great fit—even if your score is in the 600s.

Why Credit Score Still Matters in LA's Market

While there’s flexibility, your credit score does influence:

-

The loan programs you qualify for (Conventional vs. FHA vs. Jumbo)

-

Your interest rate, which affects your monthly payment

-

The down payment requirements

-

Whether or not you'll need private mortgage insurance (PMI)

As Bankrate puts it:

“Your credit score is one of the most important factors lenders consider... The higher your score, the lower the interest rates and better terms you’ll qualify for.”

In areas like Los Angeles, where property prices are among the highest in the nation, even a slight difference in your mortgage rate can mean thousands of dollars saved—or lost—every year.

How to Improve Your Credit Score Before Buying

If you're looking to boost your credit before purchasing a home in Beverly Hills or Los Angeles, here are a few expert-backed tips from the Federal Reserve Board:

-

Pay Your Bills on Time – Set up auto-pay for your credit cards and utilities.

-

Pay Down Existing Debt – Aim to keep credit card usage below 30% of your limit.

-

Check Your Credit Reports – Visit AnnualCreditReport.com to review and correct errors.

-

Avoid Opening New Credit Accounts – New credit inquiries can lower your score short-term.

Even small improvements in your score can help you secure a better rate, especially on high-value loans typical in markets like Brentwood, Holmby Hills, or the Hollywood Hills.

Final Thoughts

Your credit score is just one piece of the homebuying puzzle in Los Angeles. The bottom line? Don’t assume you’re not qualified based on an outdated myth or fear. Even in a luxury market like Beverly Hills, there are multiple lending paths available—many of which are far more accessible than buyers realize.

If you’re thinking about buying a home in LA or Beverly Hills, let’s connect. I can introduce you to top-tier lenders who specialize in high-end and first-time buyer financing. Knowing your options is the first step to making your dream home a reality.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value