Why Experts Say Mortgage Rates Should Ease Over the Next Year — And What That Means for Los Angeles & Beverly Hills Homebuyers

Why Experts Say Mortgage Rates Should Ease Over the Next Year — And What That Means for Los Angeles & Beverly Hills Homebuyers | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert

If you’ve been hoping for mortgage rates to fall — good news: they’ve already started to. But will it last? And how much lower could they go?

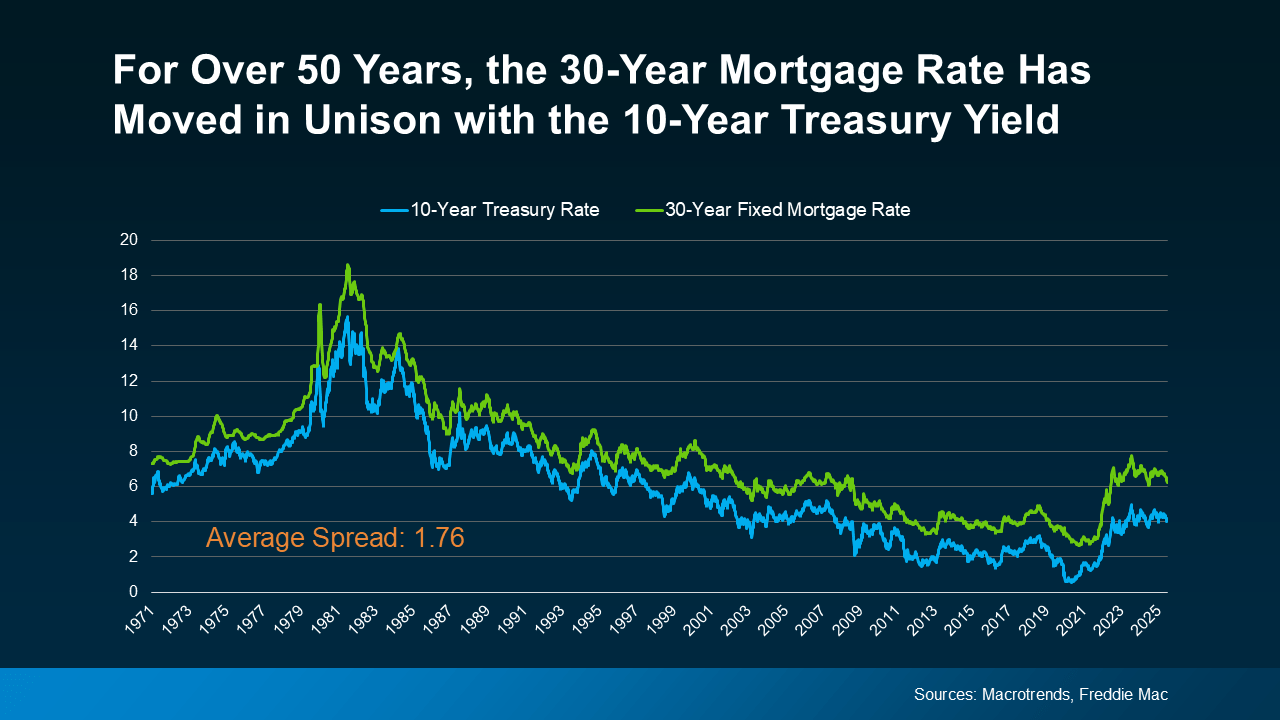

Industry analysts believe there’s meaningful room for mortgage rates to decline further over the next year. And one of the most accurate predictors to watch is the 10-year U.S. Treasury yield, which has historically moved almost in perfect sync with mortgage rates.

The Link Between Mortgage Rates and the 10-Year Treasury Yield

For more than 50 years, the 30-year fixed mortgage rate has followed the movement of the 10-year Treasury yield, which acts as a benchmark for long-term interest rates.

-

When the yield rises, mortgage rates climb.

-

When the yield falls, mortgage rates tend to ease.

This relationship has been incredibly consistent, with an average historical spread of about 1.76 percentage points. In other words, if the 10-year yield is 4.0%, mortgage rates normally hover around 5.75–5.9%.

However, since 2022, that spread has ballooned — a sign of market fear and uncertainty tied to inflation, rate hikes, and broader economic volatility.

The Spread Is Shrinking — and That’s Good News

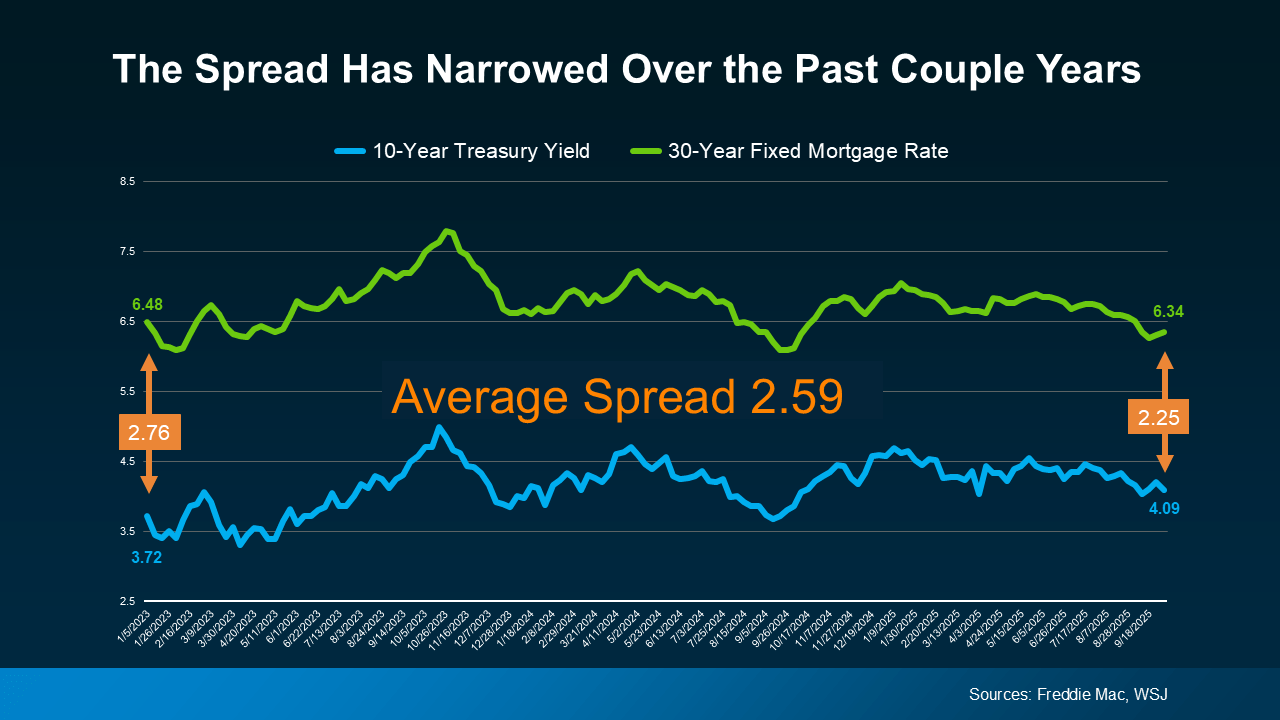

Over the past two years, the gap (or “spread”) between mortgage rates and Treasury yields reached levels unseen in decades. That’s why mortgage rates have stayed higher than expected — even as inflation cooled.

But the data now shows the spread narrowing again, a signal that investor confidence is returning and that the market is pricing in more stability.

As Redfin recently noted:

“A lower mortgage spread equals lower mortgage rates. If the spread continues to decline, mortgage rates could fall more than they already have.”

This shift is already starting to take shape — and it’s particularly meaningful for high-value markets like Beverly Hills, Bel Air, and Brentwood, where even a 1% rate difference can translate into hundreds of thousands of dollars in borrowing power.

Why the 10-Year Treasury Yield Matters

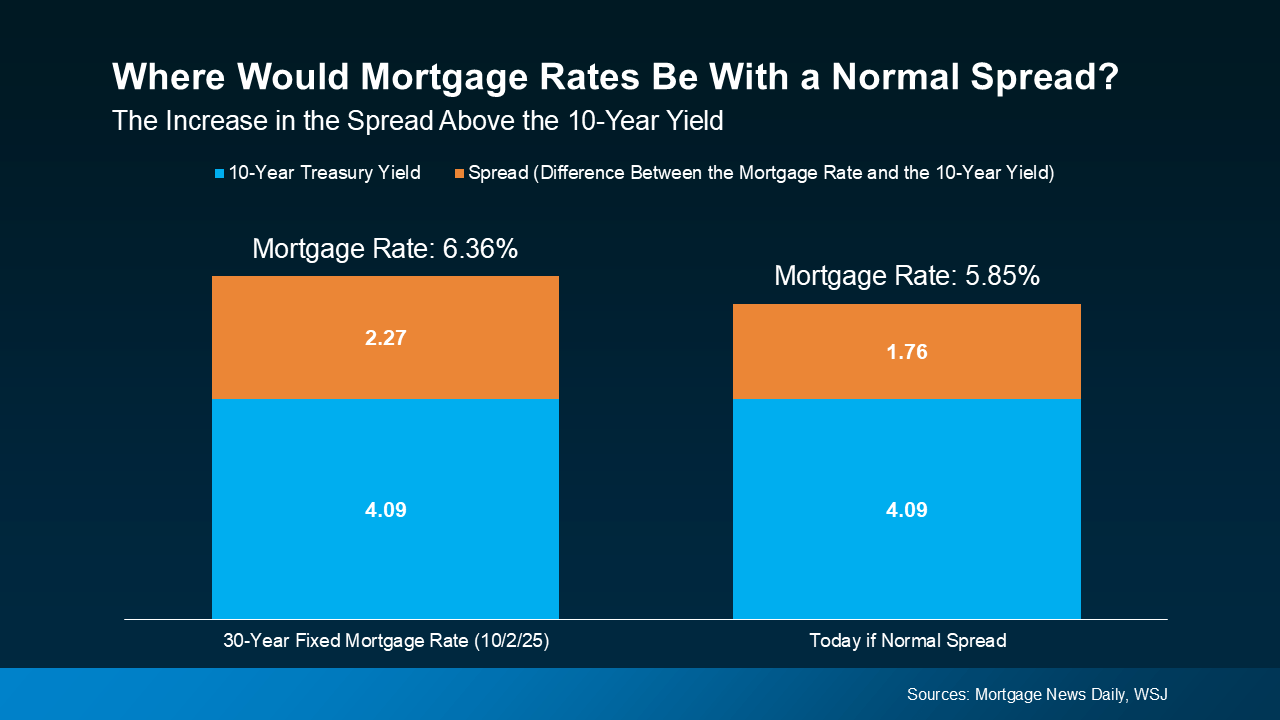

Beyond the spread itself, the 10-year Treasury yield is expected to edge lower through 2025 as the Federal Reserve pivots toward rate cuts to sustain growth.

At the time of writing, the yield sits near 4.09%. Historically, with a normal spread of 1.76%, mortgage rates would be about 5.85% — well below current levels in the mid-6s.

That means if the market continues normalizing, we could see Los Angeles mortgage rates fall toward the upper 5% range by mid-to-late 2026 — especially as inflation continues its gradual descent and the Fed signals easing.

What This Means for the Los Angeles & Beverly Hills Real Estate Market

Luxury buyers in Beverly Hills, Bel-Air, Holmby Hills, and the Sunset Strip are already watching these shifts closely. The high-end market is extremely sensitive to borrowing costs — and every 0.5% drop in rates can bring a new wave of qualified buyers back into play.

-

Buyers: Many are preparing to re-enter before rates dip fully, aiming to lock in deals before competition returns.

-

Sellers: Strategic pricing and timing will matter more than ever — a property priced correctly today could sell quickly once rates ease and demand rebounds.

Across Los Angeles, we’re also seeing early signs of pent-up demand from sidelined move-up buyers, investors, and first-time luxury entrants waiting for more favorable financing conditions.

A Quick Recap

-

The 30-year mortgage rate has historically moved in tandem with the 10-year Treasury yield.

-

The spread — the difference between them — has been abnormally high but is now narrowing.

-

If the spread normalizes and Treasury yields decline, rates could ease into the 5% range over the next 12–18 months.

-

In Beverly Hills and LA’s Platinum Triangle, lower rates will likely reignite luxury demand, reduce days on market, and strengthen high-end sales volume.

Bottom Line

The mortgage landscape is shifting, and staying ahead of these trends is essential — especially in markets as dynamic as Los Angeles and Beverly Hills.

Having a seasoned agent who understands both macroeconomic trends and local market psychology can make all the difference. I stay in close contact with top lenders, economists, and financial analysts to help my clients make informed, strategic decisions at every stage of their real estate journey.

If you’d like personalized guidance or real-time updates on where mortgage rates — and the luxury market — are heading next, let’s connect.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value