Why Your Home Equity Still Puts You Way Ahead And Why That’s Especially True in Los Angeles and Beverly Hills

Why Your Home Equity Still Puts You Way Ahead And Why That’s Especially True in Los Angeles and Beverly Hills | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert

If you’ve seen the recent headlines about slight price dips in a few U.S. markets, it’s natural to wonder what that means for the value of your home—especially here in Los Angeles, Beverly Hills, Bel-Air, or any of the Westside’s luxury enclaves.

Here’s the truth:

Even with mild moderation in some areas, most homeowners—especially in high-demand luxury markets—are sitting on extraordinary levels of equity. And that puts you dramatically ahead.

Let’s break down why.

Home Prices and Equity Move Together

Equity rises when prices rise. When prices cool slightly, equity growth slows—but it doesn’t vanish. To understand today’s environment, you need the long-view:

-

2020–2021: Historically low inventory and fierce buyer competition caused home values to surge at once-in-a-generation levels.

-

2022–2024: The market normalized. Inventory slowly increased, mortgage rates recalibrated, and price appreciation returned to a more sustainable pace.

A cooling market does not erase the massive equity gains owners have already built. It simply reflects a shift toward balance.

Perspective Is Everything: You're Still Far Ahead

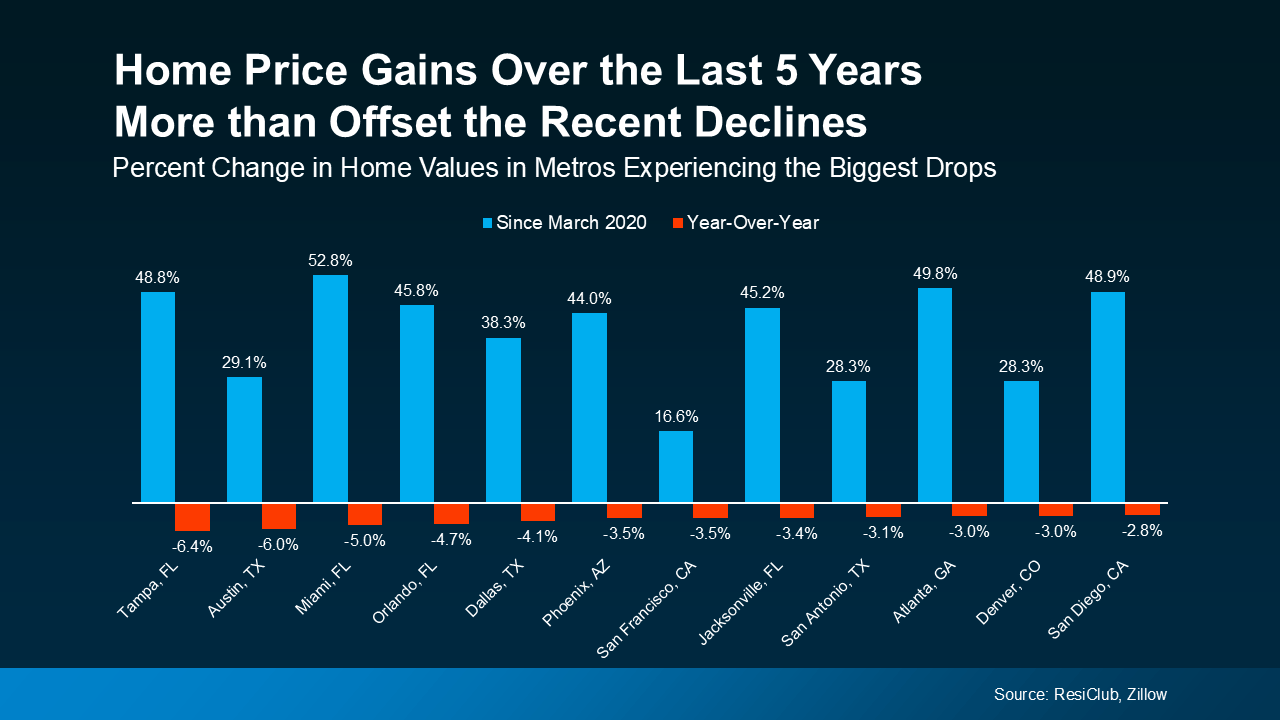

Across the U.S., home values have risen 45% since March 2020 (Zillow). Even in cities with the largest year-over-year declines, the dip averages only –4%. Those small adjustments barely dent the enormous equity built over the past five years.

The data is clear:

Five years of appreciation massively outweigh a few months of slight softening.

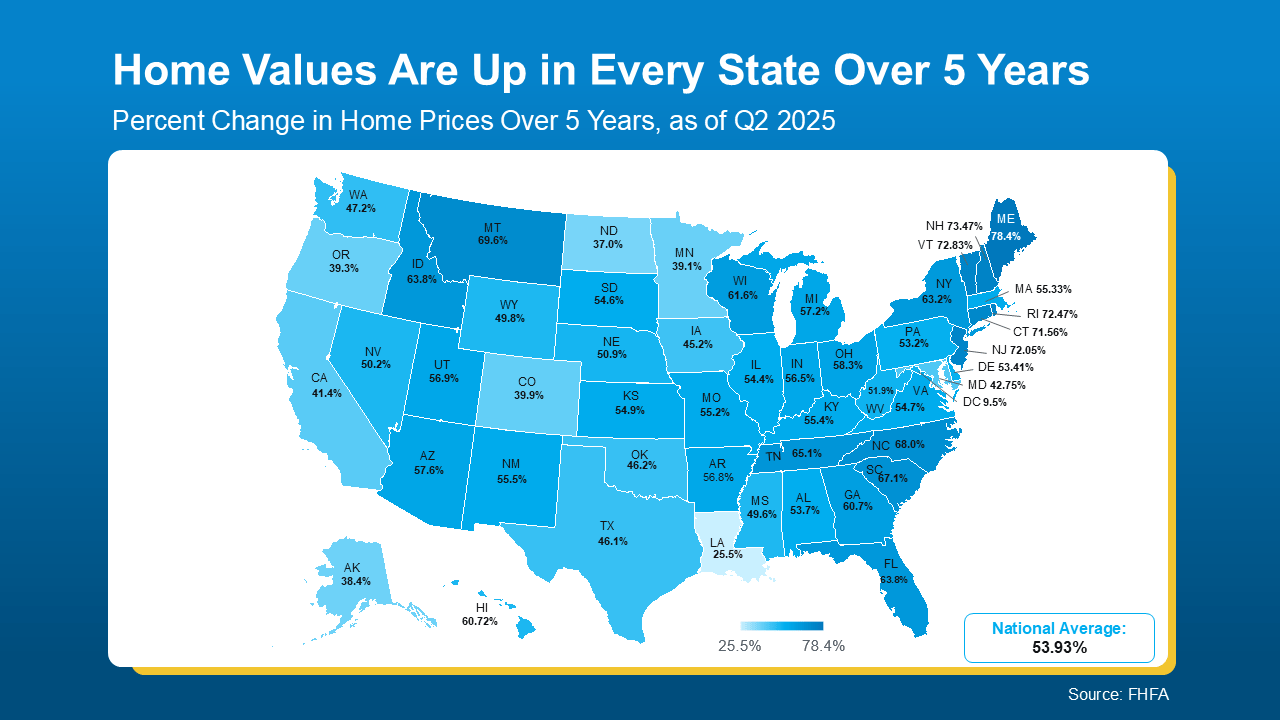

The FHFA’s five-year report shows that every state has seen home values rise—many with increases between 50% and 75%.

In short:

If you’ve owned your home for more than a few years, your equity position is extraordinarily strong.

What About Los Angeles and Beverly Hills?

Here’s where it gets even more compelling.

Los Angeles County:

-

LA County has experienced steady long-term appreciation, particularly in established luxury corridors.

-

Inventory remains historically tight across the Westside, which supports pricing power.

-

Luxury buyers—both local and international—continue targeting LA because of lifestyle, climate, high-end amenities, and global prestige.

Beverly Hills, Bel-Air, Holmby Hills, and the Platinum Triangle:

This is where long-term equity becomes a superpower.

-

Demand remains resilient from high-net-worth and ultra-high-net-worth buyers seeking privacy, architectural pedigree, and prime land.

-

Luxury properties, especially those with land, views, pedigree architects, or modern amenities, have significantly outperformed the national average.

-

Even with slight shifts month-to-month, the multi-year equity gains are enormous.

Many Beverly Hills and Bel-Air homeowners have seen 40%–70% appreciation since 2020, depending on neighborhood, lot size, and property type.

A slight softening in one quarter doesn’t change the long-term trajectory of an area where supply is fixed, heritage is strong, and global demand is constant.

The Real Story: 5-Year Gains Overpower Any Short-Term Dips

The recent moderation is simply the market returning to balance.

Here’s what the data means in practical terms:

-

A 45% national price gain over five years is monumental.

-

A –3% to –4% short-term dip in a few metros is a small ripple, not a reset.

-

FHFA shows 100% of U.S. states saw positive growth over five years.

-

In Los Angeles and Beverly Hills, long-term appreciation remains exceptional thanks to limited supply and enduring global demand.

As Realtor.com Senior Economist Jake Krimmel puts it:

“Large price declines nationally are extremely unlikely in the near term... The slight recent declines are not cause for concern.”

This is a market normalizing—not declining.

What This Means for You as a Homeowner

If you’re in Los Angeles or Beverly Hills, the odds are overwhelming that:

✅ Your equity is substantially higher than it was just a few years ago

✅ You’re in a stronger financial position than the headlines suggest

✅ If you choose to sell, your equity can help you move up, downsize, or purchase with confidence

✅ You are still sitting on near-record wealth in your property

The short-term noise doesn’t erase years of appreciation. And in Los Angeles’ luxury neighborhoods, quality inventory and limited supply only make your equity even more valuable.

Bottom Line

Even with modest price reductions in a few markets, homeowners—especially here on the Westside—remain far ahead thanks to powerful equity gains.

If you’re curious how much equity you’ve built, or what your home would command in today’s Beverly Hills or Los Angeles luxury market, I’d be happy to give you a precise, data-driven valuation.

You might be surprised at how far ahead you really are.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value